Because the Bitcoin and crypto panorama continues its speedy evolution, this week stands out as a pivotal juncture full of occasions which have the potential to reshape market sentiments and dynamics. From Bitcoin’s value efficiency to macroeconomic indicators and vital documentaries, right here’s a more in-depth take a look at the important thing occasions that each fanatic and investor needs to be keenly observing this week:

#1 Can Bitcoin Maintain Above $30,000?

Bitcoin, as in earlier early levels of a bull market, is at the moment the driving power in your entire crypto market. The escalating hope {that a} spot Bitcoin ETF could possibly be permitted by the US Securities and Alternate Fee by the top of this yr has introduced again the bullish momentum. As Google Tendencies reveals, curiosity in a Bitcoin ETF has returned amongst retail traders. Google’s Search quantity hit a 12-month excessive final week.

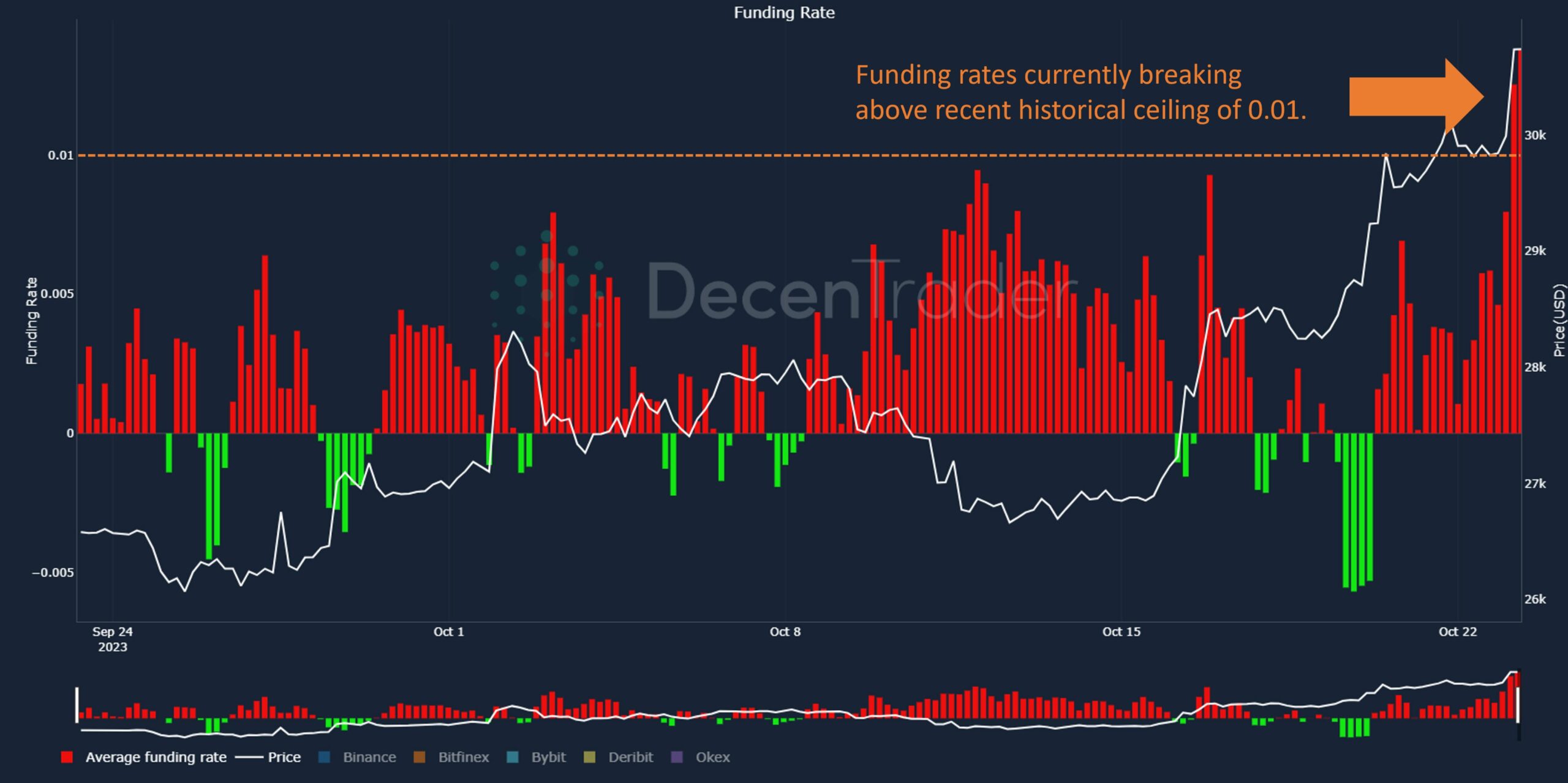

Nevertheless, it’s questionable whether or not the present motion is sustainable. Some specialists warn that futures are overheating. “Bitcoin funding charges have shortly gone from unfavourable to +0.01 as Bitcoin breaks $30,000. Merchants turning into extra bullish,” remarked the market intelligence platform Decentrader by way of X.

Nevertheless, German crypto professional Furkan Yildirim warned: “Many new Bitcoin positions are coming in by way of the futures markets. Open curiosity is at its highest stage since August and will point out that the market is beginning to overheat.”

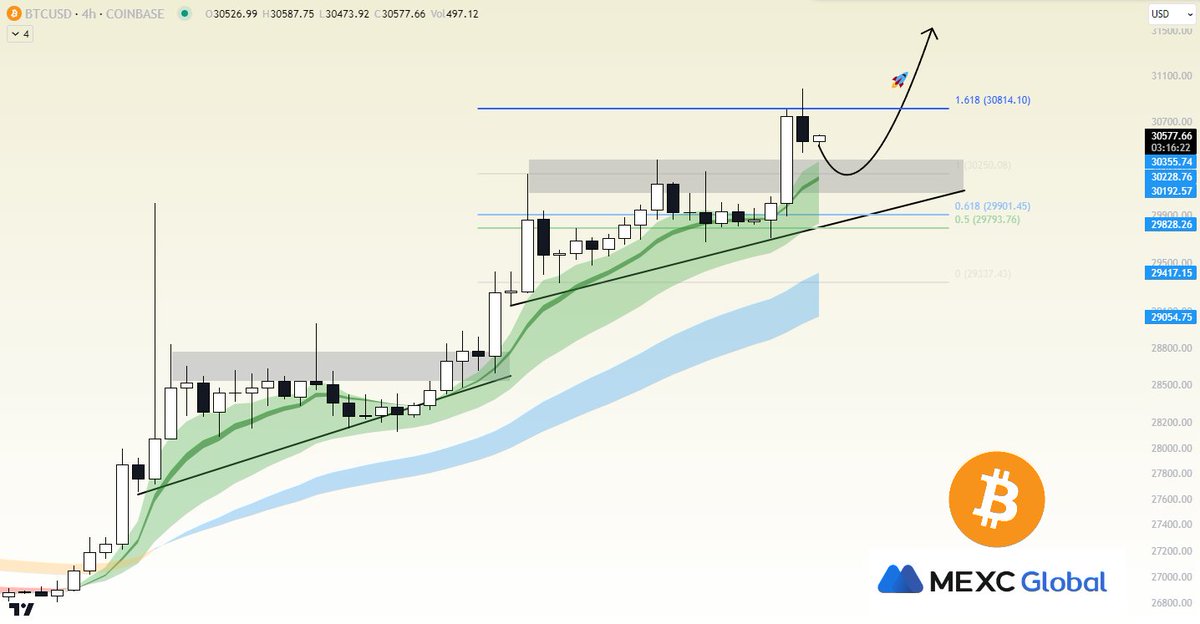

In the meantime, crypto and macro analyst Mortensen Bach tweeted: “Bitcoin: Up to now so good! Swiped the 1.618 Fibonacci extension and now we’re retesting the $30,000-$30,500 stage. What we need to see is bulls defending these $30,000 to substantiate the breakout larger!”

#2 Wednesday: Powell Speaks

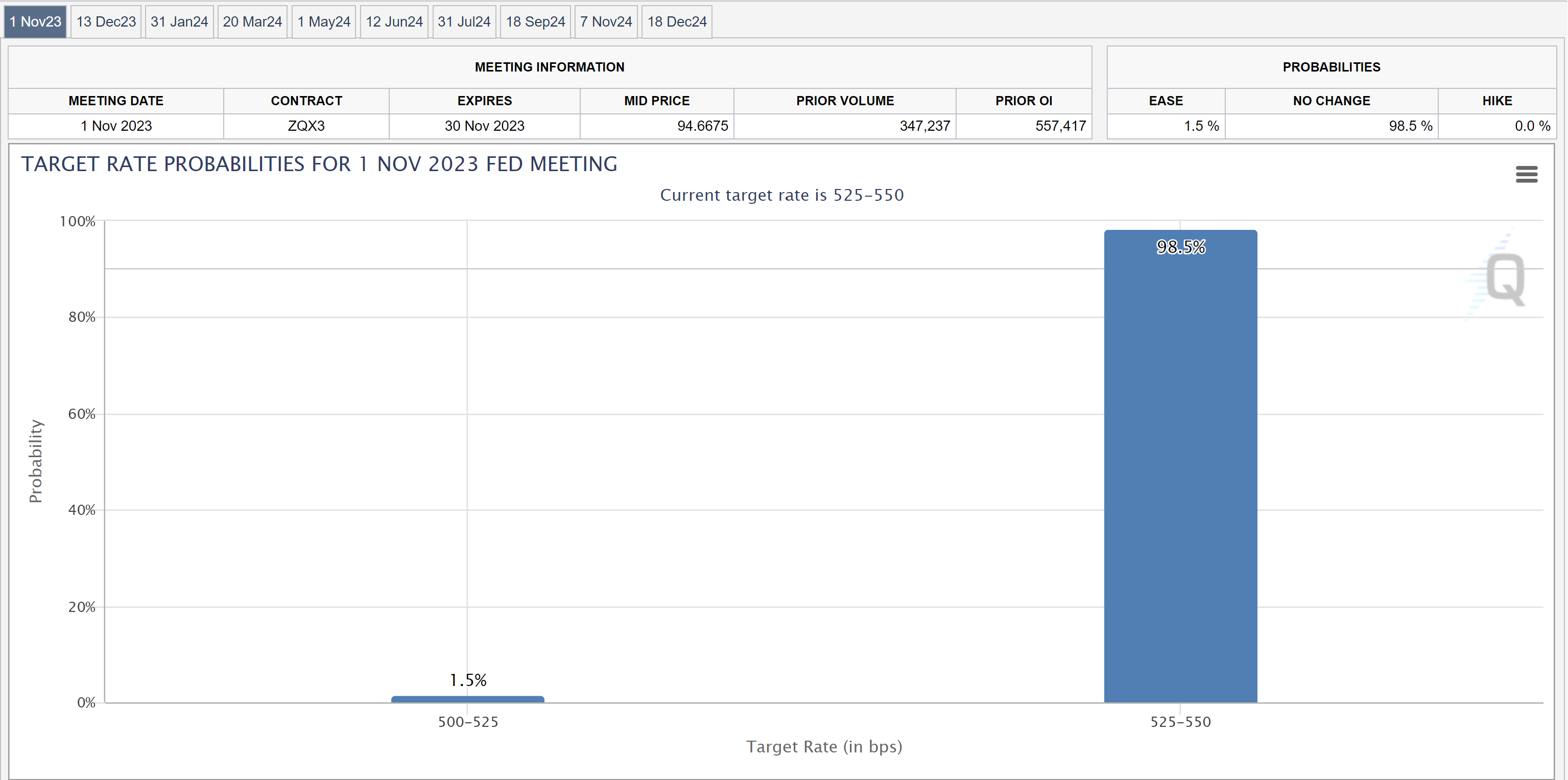

Final week’s speech by Jerome Powell moved the markets fairly a bit because the Fed chairman reiterated “larger for longer” whereas additionally signaling a charge hike pause for the upcoming FOMC assembly subsequent week, from October 31-November 1, 2023.

Amidst the turmoil within the bond market, the US yield curve stored bear-steepening with a 2-year/10-year unfold leaping 19 bps after Fed’s Powell gave the ‘inexperienced mild’ for larger long-term bond yields with 10 years nearing 5%. Though no surprises are anticipated compared to final week’s speech, a Jerome Powell speech ought to all the time be on the watchlist.

#3 Thursday: Bloomberg TV’s SBF Documentary Premieres

Bloomberg TV will unveil its much-anticipated documentary, “RUIN: Cash, Ego, and Deception at FTX” on October 26, chronicling the meteoric rise and fall of FTX’s founder, Sam Bankman-Fried (SBF). The manufacturing, shedding mild on the tumultuous journey of FTX, will supply insights into the downfall of the crypto trade.

A Bloomberg Originals manufacturing, the documentary amalgamates investigative journalism with firsthand accounts from trade insiders to color a complete image of FTX’s downfall and the following authorized challenges SBF faces. With its trailer already making a buzz since its launch on October 13, the documentary is about to be a riveting look ahead to anybody eager on the intricate dynamics of the crypto world.

#4 Friday: $3.6 Billion Crypto Choices Expiry on Deribit

Friday would possibly see pronounced volatility within the crypto realm, with $3.6 billion in notional crypto choices set to run out on Deribit, the world’s largest choices trade. Of this, $2.25 billion pertains to Bitcoin, constituting 21.4% of all BTC choices open curiosity on Deribit, and $1.35 billion to Ether (ETH), representing 22.7% of all ETH choices open curiosity as of October 20.

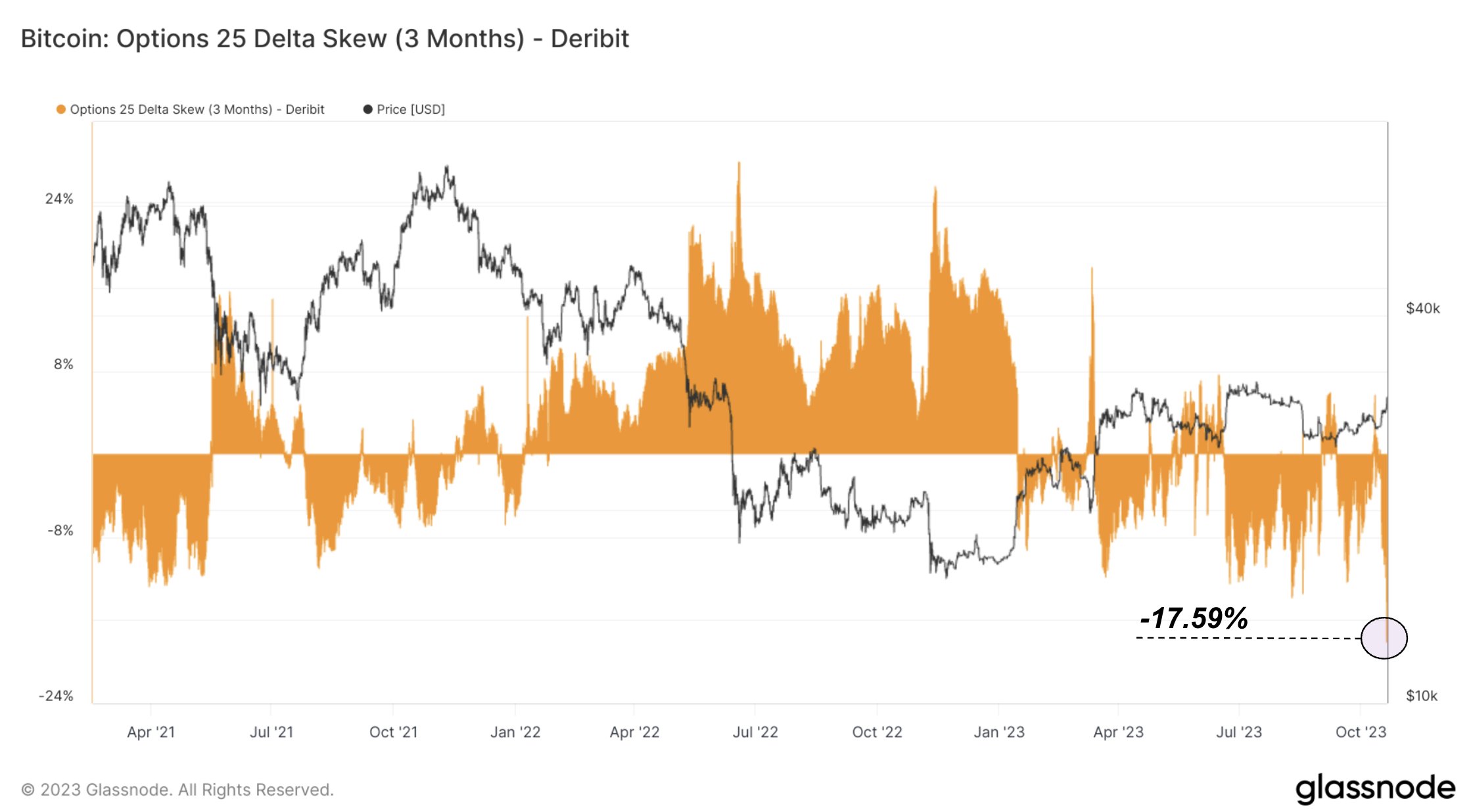

Bitcoin analyst Dylan LeClair has been on the frontline, keenly observing sturdy shifts within the choices market most not too long ago. LeClair monitored a notable pattern: “For 3-month choices, calls are buying and selling on the largest ever premium relative to places,” he tweeted.

He went on to demystify the idea of ‘skew’, emphasizing its pivotal position in gauging market sentiment. In easy phrases, a optimistic skew suggests a tilt in direction of draw back safety (or places), whereas a unfavourable one leans in direction of the upside potential (calls). Stating the bullishness on the choices market, LeClair remarked, “ choices quantity, it’s the biggest ever for a BTC transfer to not the draw back.”

#5 Friday’s US PCE Report For September

From a macro standpoint, the forthcoming US Private consumption expenditures (PCE) report for September is poised to considerably affect each the broader monetary market and the crypto panorama. Slated for launch on October 27, the PCE Index— the Fed’s inflation yardstick— will furnish insights into shopper tendencies.

This information is pivotal for economists and the Fed, providing a clearer image of financial well being earlier than the upcoming charge determination through the FOMC assembly on October 31-November 1.

With the Fed having maintained charges at 5.25%-5.50% throughout its September 2023 FOMC assembly, analysts eagerly await the core PCE particulars. Anticipations are rife for a “hawkish pause” continuation, fortified by any core PCE readings aligning with or falling under predictions.

Additional: Thursday – Q3 2023 US GDP

Past the realm of crypto, the announcement of the Q3 2023 US Gross home product (GDP) may even seize vital consideration this week, doubtlessly influencing broader market sentiments.

For traders, this week guarantees a riveting mix of occasions and revelations. From Bitcoin’s efficiency trajectory to pivotal macroeconomic updates, the approaching days are pivotal for anybody keenly monitoring the Bitcoin and crypto panorama and broader monetary markets.

At press time, BTC traded at $30,570.

Featured picture from Shutterstock, chart from TradingView.com