The Markets in Crypto Property (MiCA) regulatory framework is the European Union (EU)’s try to offer regulatory readability within the area’s crypto and digital asset sector. It introduces a unified, complete, and constant algorithm for crypto-assets and addresses areas not at the moment lined by current monetary legal guidelines.

MiCA covers every part from transparency, disclosure, authorization, and supervision for these coping with crypto belongings like asset-reference tokens and e-money tokens. It’s pivotal within the European Fee’s efforts to advertise innovation and competitors within the digital finance sector.

The regulatory framework is predicted to boost market integrity, monetary stability, and shopper consciousness concerning the dangers of public affords involving crypto-assets.

MiCA was formally handed into regulation by the European Parliament on April 20, 2023, and it’s scheduled to return into impact in December 2024.

Who Does MiCA Apply To?

Usually, MiCA applies to a few distinct teams:

Crypto Asset Issuers: This doesn’t essentially confer with the entity that originally created the cryptoassets. As a substitute, it refers back to the “authorized particular person providing cryptoassets to the general public” or making an attempt to listing them on a cryptoasset buying and selling platform. The principles fluctuate primarily based on the kind of cryptoasset in query.

Crypto Asset Service Suppliers (CASPs): This class contains people or companies providing crypto providers to others professionally.

Crypto Asset Merchants: This contains anybody engaged in buying and selling cryptoassets on approved platforms or these in search of admission to commerce on such platforms.

What Does MiCA cowl?

Along with these three teams, MiCA additionally regulates varied crypto belongings and providers, categorizing them into 4 major varieties:

E-money Tokens (EMTs): EMTs are crypto belongings primarily used for funds. These crypto belongings, akin to stablecoins backed by a single fiat forex, typically preserve a steady worth by being linked to an official forex. Examples embody Binance USD (BUSD), Paxos Customary (PAX), or TrueUSD (TUSD).

Asset-Referenced Tokens (ARTs): ARTs are crypto-assets designed to protect a steady worth by being linked to varied values or rights, together with official currencies. They embody stablecoins backed by a number of fiat currencies, crypto-backed stablecoins, and commodity-backed stablecoins, sometimes called stablecoins or international stablecoins. Notable examples of ARTs embody Tether (USDT), USD Coin (USDC), or Libra (now Diem).

Utility Tokens: These are crypto belongings meant to supply digital entry to items or providers, whether or not on or off the ledger the place they’re issued. They’re often known as software tokens or community tokens. Examples of those utility tokens embody Fundamental Consideration Token (BAT), Chainlink (LINK), or Uniswap (UNI).

Different Crypto Property: This class contains crypto belongings that don’t fall below the EMT or ART classifications. They don’t seem to be regulated as monetary devices below MiFID II and will be known as cost or funding tokens. Examples of such different crypto belongings embody Bitcoin (BTC), Ethereum (ETH), or Ripple (XRP).

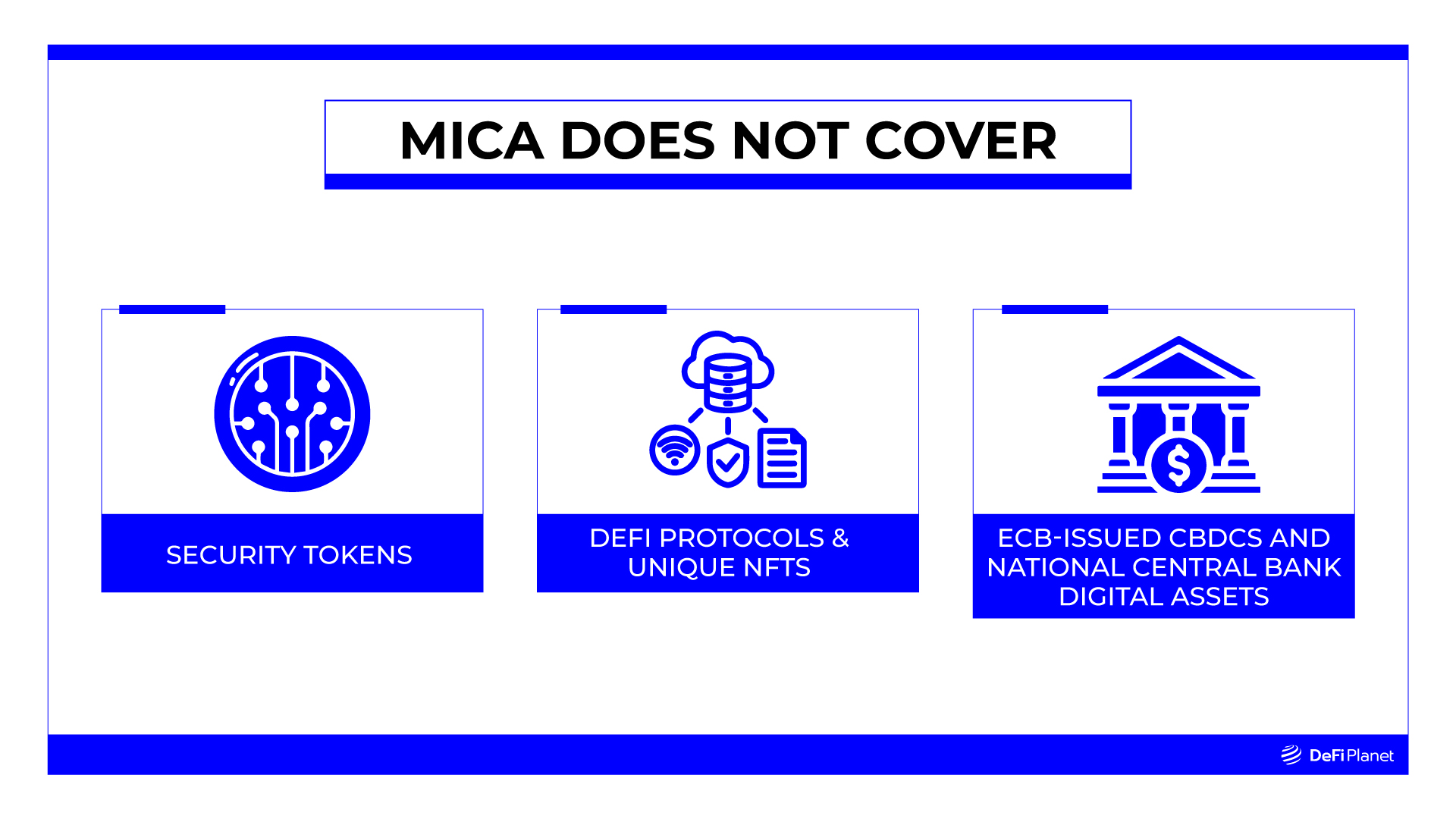

What Is Not Coated by MiCA?

MiCA doesn’t cowl the next:

1. Safety Tokens

MiCA excludes safety tokens that meet the factors of transferable securities, together with different cryptoassets that qualify as monetary devices below MiFID II. It additionally doesn’t cowl deposits, securitization positions, insurance coverage, or pension merchandise.

2. DeFi Protocols and Distinctive NFTs

At the moment, MiCA doesn’t absolutely deal with DeFi protocols and distinctive Non-Fungible Tokens (NFTs). Nevertheless, it features a evaluate clause which will lead to devoted laws for these areas sooner or later if deemed obligatory.

NFTs are typically not topic to regulation except they emulate monetary devices or if the issuer creates a “assortment” of belongings on the market. This method permits artists and firms to create digital belongings with out dealing with complicated regulatory necessities. Nonetheless, firms managing NFT collections should furnish a white paper explaining their product and the way it capabilities on the blockchain.

3. ECB-Issued CBDCs and Nationwide Central Financial institution Digital Property

MiCA doesn’t cowl European Central Financial institution (ECB)-issued Central Financial institution Digital Currencies (CBDCs) or digital belongings issued by nationwide central banks when they’re appearing of their financial authority function. Moreover, providers associated to those cryptoassets offered by central banks are additionally excluded from MiCA’s purview.

What Are the Advantages of MiCA?

MiCA affords quite a few benefits to the EU crypto trade, with particular advantages relying on elements such because the asset, supplier measurement, readiness, and compliance ranges. Listed here are among the key advantages:

Authorized Readability and Certainty

MiCA establishes clear definitions and classifications for crypto belongings and providers within the EU. This reduces confusion and uncertainty for each crypto customers and suppliers, clarifying their rights, obligations, and dangers. Total, it enhances belief within the regulated crypto sector, portraying it as professional, managed, and supervised.

Sustained Market Integrity

MiCA makes crypto markets extra clear and honest by implementing guidelines towards market abuse, insider buying and selling, and worth manipulation. This ensures that crypto markets function effectively and replicate the true provide and demand for crypto belongings. Moreover, it can entice extra members, buyers, and merchants to the crypto area, rising market liquidity and depth.

Shopper Safety

MiCA’s important goal is to make crypto safer for customers. It achieves this by introducing guidelines concerning disclosure, governance, rights, and tasks. Moreover, it implements measures to stop fraud, hacking, scams, and different crypto-related dangers.

These provisions guarantee crypto customers have entry to dependable data, honest therapy, and efficient cures, finally bolstering their confidence and satisfaction within the crypto trade.

Monetary Stability

MiCA will cut back the dangers that crypto belongings can deliver to the monetary system by organising guidelines to observe and handle these dangers. This ensures that crypto belongings gained’t hurt the soundness or operation of the monetary system or different markets. It additionally encourages monetary resilience and innovation within the crypto sector, permitting crypto belongings to work alongside different monetary devices and providers.

Innovation and Competitiveness

MiCA will stimulate the EU’s crypto sector by establishing honest guidelines and a unified marketplace for crypto belongings and providers. And this encourages innovation, funding, and the adoption of recent applied sciences and enterprise fashions within the crypto trade. It additionally enhances competitiveness and variety by permitting newcomers and smaller gamers to compete with established ones.

Potentials Challenges to MiCA’s Effectiveness

Regardless of its advantages, MiCA presents a number of challenges that can have an effect on its effectiveness:

Regulatory Complexity

MiCA introduces detailed laws, they usually may very well be fairly difficult to understand and implement. Complexities might come up from MiCA’s scope, definitions, classifications, exceptions, interactions with different EU guidelines, or discrepancies amongst member states. Thus, it would pose challenges for each crypto customers and suppliers, who might require authorized help, in addition to for authorities accountable for enforcement.

Compliance Prices

MiCA will deliver new guidelines and duties for crypto asset issuers and suppliers. Complying with the brand new laws might imply spending extra, together with charges for licenses, reporting, audits, implementation of measures, or fines for not following the foundations.

Although the prices will differ primarily based on the crypto asset or supplier’s kind, measurement, readiness, and compliance stage, they could influence the profitability and sustainability of sure crypto initiatives or companies.

Implementation Uncertainty

MiCA is about to take impact in 2024, following a transition interval of 12 to 18 months. Nevertheless, there are uncertainties concerning how MiCA will probably be applied in observe.

These uncertainties might stem from differing interpretations and functions of MiCA by member states or authorities, the provision of appropriate technical and operational options, or the responses of market members.

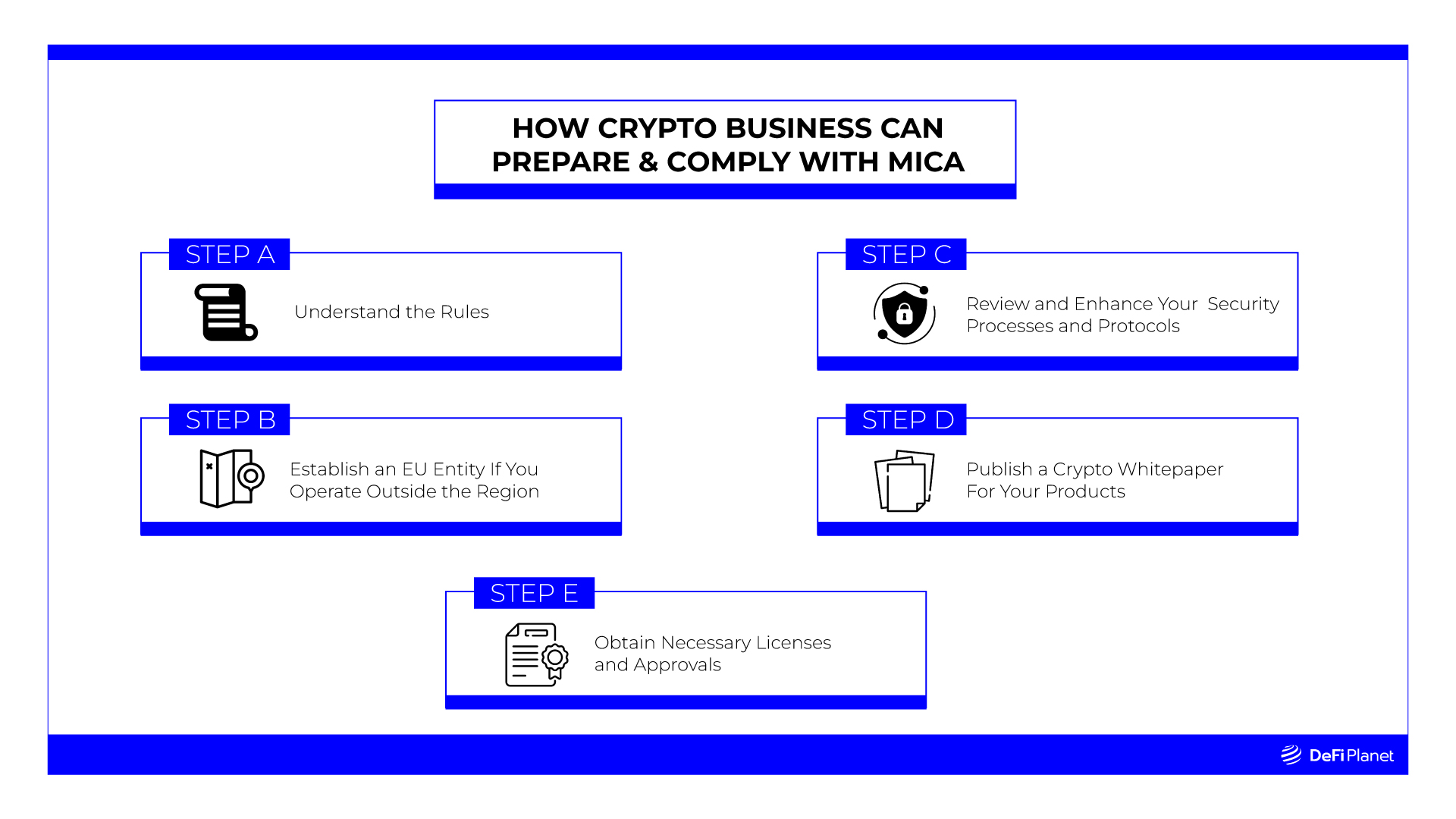

The best way to Put together to Comply With MiCA?

MiCA will deliver substantial modifications and challenges to the EU crypto trade which would require preparation and compliance from crypto asset issuers and repair suppliers.

Listed here are important issues crypto companies should do to arrange for MiCA compliance within the EU:

Perceive the Guidelines

Enterprise homeowners should familiarize themselves with the particular laws relevant to their crypto enterprise and assess how they influence their operations, merchandise, and providers. This entails comprehending the authorized and regulatory panorama for crypto-assets and classifying differing kinds.

Set up an EU Entity

As a crypto service supplier or issuer, if you happen to provide providers to EU residents and are primarily based exterior the area, it’s essential to determine a authorized entity within the area. In some instances, this may occasionally necessitate having a registered workplace in an EU member state, whereas others might contain particular institution standards.

Evaluation and Improve Safety Processes and Protocols

Conduct an intensive evaluate of your techniques and safety protocols to make sure they align with EU requirements. That is important for safeguarding knowledge safety, integrity, and confidentiality.

Publish a Crypto Whitepaper

MiCA mandates digital asset issuers to arrange and publish an in depth crypto whitepaper. This doc ought to embody complete details about the issuer, the challenge, monetary elements, expertise, dangers, and extra. Be sure that the content material and format align with the classification of the crypto asset.

Search Obligatory Approvals

Relying in your crypto asset or service, you might want permits, authorizations, or certifications from nationwide authorities.

In Conclusion

Whereas it might current challenges, MiCA additionally brings alternatives for the trade to develop and develop in a extra regulated and safe setting. Cooperation amongst stakeholders and authorities will probably be important in efficiently implementing and adapting to the brand new regulation.

Total, companies working within the crypto trade want to pay attention to their obligations below MiCA and take the required steps to make sure compliance.

Although the laws are directed towards companies, people have their roles to play, too.

They have to keep knowledgeable and up to date concerning the newest developments and information concerning MiCA. And guarantee they perceive how the regulation might influence their crypto actions and investments.

Moreover, people can actively take part in public consultations and supply suggestions to assist form the implementation of MiCA in a method that’s useful for all stakeholders. By staying engaged and concerned, people may also contribute to the event of a sturdy and inclusive regulatory framework for the EU crypto trade.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you want to learn extra articles (information studies, market analyses) like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”