Bitcoin (BTC), the world’s main cryptocurrency, continues to face challenges in reclaiming the $28,000 stage amid rising US treasury yields, a stronger greenback, and geopolitical uncertainties.

Nonetheless, in accordance with a report by the digital asset analysis agency Reflexivity, regardless of these obstacles, Bitcoin stays the standout performer amongst asset lessons in 2023, with a formidable year-to-date (YTD) return of 63.3%.

This distinctive efficiency has surpassed returns from US large-cap progress shares (28%), US large-cap shares (13%), bonds, commodities, and REITs, in accordance with a report from New York-based Bitcoin funding agency NYDIG.

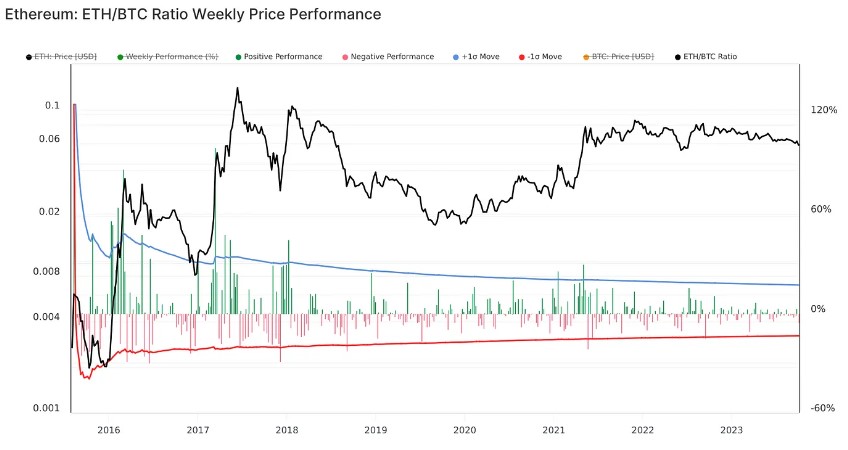

ETH/BTC Ratio Displays Threat Urge for food And BTC’s Power

In line with the agency’s newest evaluation of the present state of the Bitcoin market, there’s a notable significance in monitoring Bitcoin’s market cap dominance, which measures Bitcoin’s market capitalization as a share of the full crypto market capitalization.

Market contributors typically view this metric as a danger gauge for the broader crypto market. Simply as conventional markets expertise cycles, with early levels marked by capital focus in a choose few high-quality property that steadily disperse into riskier property, the crypto market follows a related sample.

The cycle commences with capital concentrated in Bitcoin, then dispersion into Ethereum (ETH) and ultimately different altcoins. The cycle concludes with capital flooding into high-risk property, as witnessed within the memecoin frenzy of 2021.

The report’s chart illustrates the rising dominance of Bitcoin, indicating a wholesome focus of capital into the main asset. Bitcoin’s sustained dominance means that the crypto market is steady, with important capital nonetheless flowing into Bitcoin.

Alongside monitoring Bitcoin dominance, one other key indicator of risk-taking habits within the crypto market is the ETH/BTC ratio, which compares Bitcoin’s efficiency to Ethereum, the second-largest cryptocurrency by market capitalization.

The chart demonstrates a downward pattern within the ETH/BTC ratio because the Merge in September 2022, which, in accordance with the report, each Bitcoin dominance and the ETH/BTC ratio can be essential to observe for any potential shift from a Bitcoin-dominated market regime into higher-risk property.

Bitcoin Eyes Bullish Momentum

After a two-month consolidation interval between the $26,000 and $27,000 vary, BTC lastly skilled a surge of bullish momentum, breaking the sample and climbing to the upside.

Nonetheless, the cryptocurrency’s upward trajectory was halted because it encountered a formidable resistance wall within the mid-term, reaching $28,600 on October 2nd and going through a major hurdle at $28,700.

This resistance stage poses one of many ultimate challenges stopping BTC from revisiting the $30,000 mark, final seen in August.

Regardless of the setback, Bitcoin at present trades above its essential 50-day and 200-day transferring averages (MAs), indicating the potential for one more try and breach beforehand misplaced ranges.

Market analysts and fans are carefully watching the $27,700 mark, as a profitable break may sign the formation of an ideal ‘W’ sample, with a goal set at $28,100.

On this matter, famend crypto YouTuber and founding father of Crypto Sea, generally known as ‘Crypto Rover,’ highlights the importance of the $27,700 stage as a possible catalyst for Bitcoin’s subsequent transfer.

In line with the analyst’s newest submit on X (previously Twitter), a profitable breakthrough may reignite bullish sentiment and pave the best way for a push towards the $28,100 goal.

BTC is buying and selling at $27,300, experiencing a modest decline of 0.6% over the previous 24 hours. Nonetheless, the cryptocurrency has recorded notable features of 4.4% and 6% over fourteen and thirty days, respectively.

Featured picture from Shutterstock, chart from TradingView.com