This piece continues from A Most Ridiculous World: The Politicization of Vitality from yesterday.

Feeding the Grown and the Rising

Stern, Burke and Bruns (2016)7 concluded of their evaluation that entry to electrical energy isn’t ample for financial development however that electrical energy use and GDP have a constructive relationship. Merely offering the supply of a useful resource doesn’t dictate development, it’s the use that leads to development. Widespread sense.

“Consequently, power is a necessary issue of manufacturing and steady provides of power are wanted to take care of present ranges of financial exercise in addition to to develop and develop the economic system (Stern, 1997). There might also be macroeconomic limits to substitution of different inputs for power. The development, operation, and upkeep of instruments, machines, and factories require a stream of supplies and power. Equally, the people that direct manufactured capital devour power and supplies. Thus, producing extra of the substitutes for power requires extra of the factor that it’s purported to substitute for. This once more limits potential substitutability (Cleveland et al., 1984).”

– The Influence of Electrical energy on Financial Improvement: A Macroeconomic Perspective (2017)

The issue is that this witch’s brew of ESG over exuberance, demonization of oil & fuel, and local weather catastrophization has prompted a bubbling-up of power moralization dialogue and social pressures to focus particularly on emissions of power technology. Whereas ignoring discussions of reliability of electrical energy provision and the capability of supporting infrastructure. And but, additionally ignoring the true substitutability of oil & fuel (reasonably the dearth of substitutability), from our present state. All of that is underneath the intent of creating limitations on the consumption of power and energy. A strictly anti-growth mission. As now we have acknowledged, being anti-growth for an ecosystem is patently pro-catastrophe.

Focusing solely on emissions with out additionally contemplating the necessity to keep availability, reliability, capability, and low-cost prices, solely leads to a cannibalization of already established infrastructure – weakening provisions for growing and supplying progressive new strategies to proceed bettering efficiencies (together with lowering technology of waste and air pollution). These rising inefficiencies would then additionally result in inviting inefficiencies in power technology and electrical energy provision, resulting in will increase in prices of manufacturing and dwelling. Snowballing to a discount of dwelling requirements throughout the board, and furthering the inefficiency drawback(s).

This will get us again to the ridiculousness of over tribalization and politicization of our power producing initiatives and infrastructure. The mixed smear campaigns of hydrocarbons (oil & fuel) and nuclear, and the pedestalization of renewables (wind & photo voltaic), with the entire exclusion of hydropower from these discussions, invitations important fragility to already developed economies.

“Whereas photo voltaic power is considerable and inexhaustible, it’s diffuse in comparison with fossil fuels, and vegetation solely seize about 1% of the power in daylight. Subsequently, the utmost power provide in a biomass-dependent economic system is low, as is the ‘power return on funding’ for the human-directed power expended to extract power. That is why the shift to fossil fuels in the Industrial Revolution was so essential in releasing constraints on power provide and, subsequently, on manufacturing and financial development (Wrigley 2010).

Despite this, core mainstream financial development fashions disregard power or otherresources (Aghion and Howitt, 2009), and power doesn’t characteristic strongly in analysis on financial improvement (Toman and Jemelkova, 2003).”

– The Influence of Electrical energy on Financial Improvement: A Macroeconomic Perspective (2017)

In the end suggesting that to attempt to “phase-out” already entrenched power assets and sources of energy by pressure (similar to by means of laws), reasonably than by means of free market dynamics, is a idiot’s errand and an extra waste of time and assets. Making the legislators like these within the clip offered on the very starting of this essay involving Jamie Dimon explicitly comical. Not solely as a result of these approaches would virtually actually break the system itself in the event that they had been to succeed, however such exercise can be met with such aggressive resistance as a result of rising prices of energy that the greater than probably lashback might end in a profitable protection of the system itself anyway. In the end resulting in solely failure, no matter which of those outcomes happens.

Typically, a properly functioning society continues to make the most of entrenched power sources whereas utilizing essentially the most environment friendly and dependable energies in larger percentages to additional enhance efficiencies of those strategies, whereas additionally working to develop regularly extra progressive and rewarding sources of power. Enhancing the economics and return on funding in power technology itself, which in the end uplifts the requirements of dwelling. A constructive suggestions loop.

Let’s check out the funding relationship close to power technology, capability, and infrastructure itself.

Vitality and Return On Funding

Stern and Kander (2012) concluded that rising inhabitants with out additionally rising power provide leads to a degradation of output8 – shocker. Stern and Kander produced their very own model of the Solow Mannequin to incorporate a low substitutability power supply (similar to oil and fuel) in addition to labor into financial projections, as they believed that present financial fashions don’t adequately incorporate the financial significance of power to the well being of an economic system, significantly when developed nations with increased entry to dependable energy and power. Doing this introduced them to a further conclusion that rising provide of power, alongside inhabitants, and using technological developments that increase power technology, enhance output. Once more, shocker. However extra importantly, this is able to counsel that power technology augmentation, whereas rising entry to power (in addition to provide), improves utilization and output, thereby boosting GDP, even for already developed nations.

The Solow Mannequin and the Regular State

For people who have no idea what the Solow Mannequin is (and didn’t watch the academic YouTube video that I so graciously offered above to help your understanding), let’s take a quick detour.

The Solow Mannequin

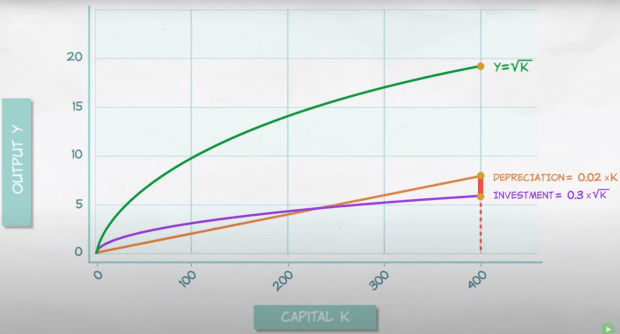

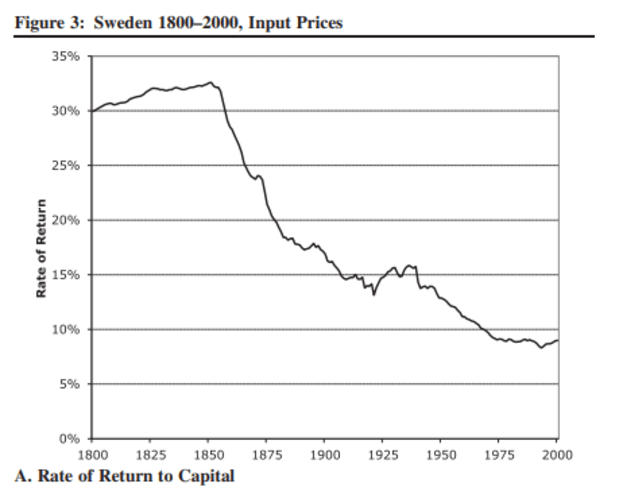

The Regulation of Diminishing Returns, when plotted in opposition to depreciation (which is a continuing), and incorporating funding and fee of return on these investments, leads to a trajectory that approaches break-even over time. Later leading to unfavorable returns on funding on an extended sufficient timescale. This dynamic is especially actual within the power infrastructure and output dialogue close to civil improvement and the well being of an economic system. What this exhibits is that nations which are underneath developed and incorporating fashionable applied sciences in power technology and distribution obtain larger returns within the early phases with diminishing returns as power availability and use throughout their nation turns into ubiquitous. Main nations which have saturated entry to dependable energy (just like the US & Europe) to see slower return on funding than do the underdeveloped nations which are taking part in catch-up by deploying fashionable methods. Is sensible.

What this additionally suggests is that failing to efficiently deploy regularly bettering methodologies and applied sciences for producing, capturing, distributing, storing, and using power leads to prices of mere upkeep that may start to eat at funding. That means you’re losing increasingly time, effort, and assets to easily tread water whereas solely managing to gradual your individual degradation, and achieve zero floor. Requiring a relentless seek for bettering our capabilities in every little thing associated to power; we can not afford to cease. To cease on the lookout for larger sources, strategies of seize, distribution, utilization, and consumption methods would fairly actually result in expiration.

The Solow Mannequin & Vitality

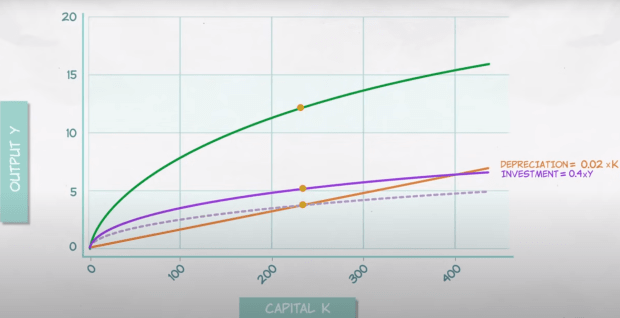

What Stern and Kander elucidate is that when developments in technological augmentation of power technology are included right into a rising inhabitants base, alongside bettering utilization of power, economies can prolong the lifetime of the Solow mannequin to keep away from crossing the break-even junction. Successfully permitting for constant GDP growth, very similar to the US has skilled over the previous two centuries.

Determine 4. Supply: The Solow Mannequin and the Regular State, Marginal Revolution College

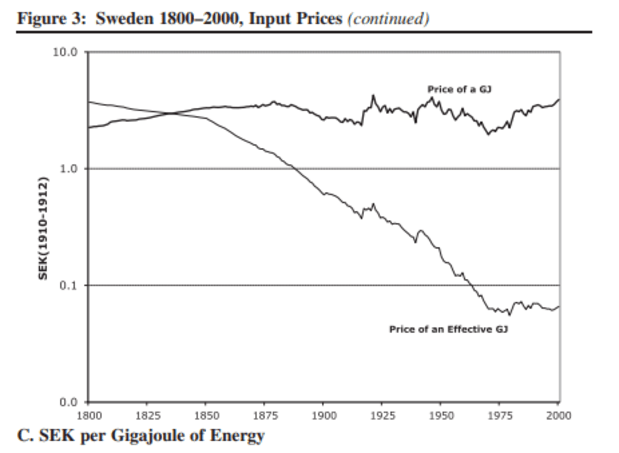

By innovating power technology with augmentative applied sciences and methodologies, rising the entry and capability of power, and rising the inhabitants base, we get costs of efficient power that proceed to development in the direction of 0. In layman’s phrases; we’re getting larger and larger returns for the quantity of power that’s being consumed by getting extra work completed. Though we proceed to devour extra power than we ever have.

Determine 6. Supply: https://crawford.anu.edu.au/distribution/e-newsletter/research-newsletter/pdf/Vitality-Journal-Stern.pdf

Tomorrow we’ll go into the ways in which Bitcoin mining synergizes with these dynamics.

It is a visitor publish by Mike Hobart. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.