On this article, we demystify cross-chain bridging, explaining its idea, operation, and how one can harness it to attach with varied blockchains utilizing rhino.fi.

Because the crypto panorama evolves in the direction of DeFi, understanding cross-chain bridge mechanics is essential to unlocking the potential inside every ecosystem. From multi-chain bridging to the nitty-gritty of crypto bridge operations, we’ve bought you coated.

Glossary: Bridge in DeFi

Bridging to the massive variety of Layer 2s that rhino.fi connects to couldn’t be less complicated.

All you’ll want is a MetaMask pockets, some ETH (or the related chain asset), and some minutes, and also you’ll be navigating like a professional. Whether or not it’s bridging to zkSync or hopping over to opBNB, Rhino.fi has your again, providing the most affordable and quickest transactions on the town.

We will likely be updating this weblog with step-by-step guides to every ecosystem, so examine again in for brand spanking new guides to be added quickly.

What’s Cross-Chain Bridging?

Blockchains are designed as remoted islands, every with its distinctive guidelines and code. Whereas this robustness provides safety, it additionally isolates these islands, making it difficult for them to speak. Should you maintain property on one blockchain, you’re free to discover, change, and have interaction inside that ecosystem. Nonetheless, transferring tokens between totally different blockchains isn’t simple.

Within the conventional fiat world, swapping currencies between totally different lands is a breeze. The crypto world ought to be no totally different. That’s the place bridges come into play. Bridges act as intermediaries, bridging the foundations and code of two distinct blockchains, enabling information and worth to stream seamlessly.

How Bridges Are Categorized: Switch sorts and Belief Assumptions

Bridges will be categorised by each switch kind (easy to advanced), and belief assumptions (robust to weak). Let’s take care of switch sorts first.

There are 5 forms of bridges, though the design area is giant and the strains are blurred. The 5 fundamental forms of bridges, in response to switch kind, are:

Lock & Mint e.g. Polygon official bridge, StarkNet official bridge, Shuttle. Token Issuer Burn & Mint e.g. MakerDao, Arbitrum Teleport. Specialised Burn & Mint e.g. Hop, Debridge. Atomic Swap e.g. Stargate. Third Get together Networks/Chains e.g. Thorchain.

We’ve written earlier than about switch sorts, you possibly can learn it right here.

Along with varied token switch strategies, contemplating belief assumptions is essential. Every bridge falls on a spectrum from robust trustworthiness (not very best) to weak trustworthiness (most popular). Belief ranges will be categorized as follows:

Centralized Bridges e.g. the Binance-to-Arbitrum bridge.Validator/Multi-Sig Bridges e.g. Wormhole, Axelar, and Connext.State Proof Bridges e.g. StarkEx to Ethereum, ZKSync to Ethereum, Nomad, Hop, Axelar, and Mina.Protocol-Degree Bridges e.g. Cosmos IBC.

How does the Rhino.fi Bridge Work?

At Rhino.fi, we function a system primarily based on collateralized bridges and liquidity outposts—token swimming pools strategically positioned throughout varied chains, backed by us.

The driving drive behind this course of? Sensible contracts.

Customers provide rhino.fi with property on one chain, and thru our good contracts and StarkEx expertise, rhino.fi gives corresponding property from our pool on one other chain.

The advantages of this methodology lies in its adaptability, enabling seamless onboarding for brand spanking new chains. In essence, we are able to carry you the most well liked chains as quickly as they launch. It additionally ensures a seamless consumer expertise with one-click bridging and practically prompt transactions—deposits inside minutes, withdrawals inside seconds.

We’ve written extra extensively about this right here.

Use the Rhino.fi Bridge

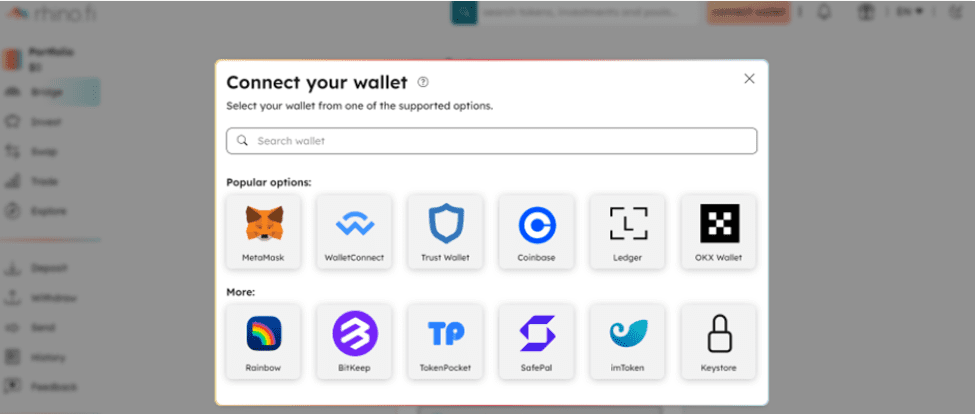

Step 1: Join your pockets

When getting into the app for the primary time, you will notice a ‘join pockets’ button within the high proper hand nook.

After clicking ‘join pockets’ you should have the choice to pick out from a variety of pockets sorts. Select your pockets, and comply with the steps to attach.

The connection methodology varies for every kind of pockets. For instance, to attach a MetaMask pockets to rhino.fi, customers must entry the MetaMask pockets through their browser (or obtain the software program in the event that they haven’t already).

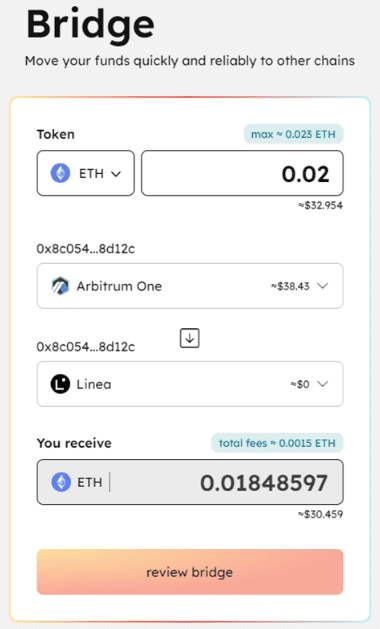

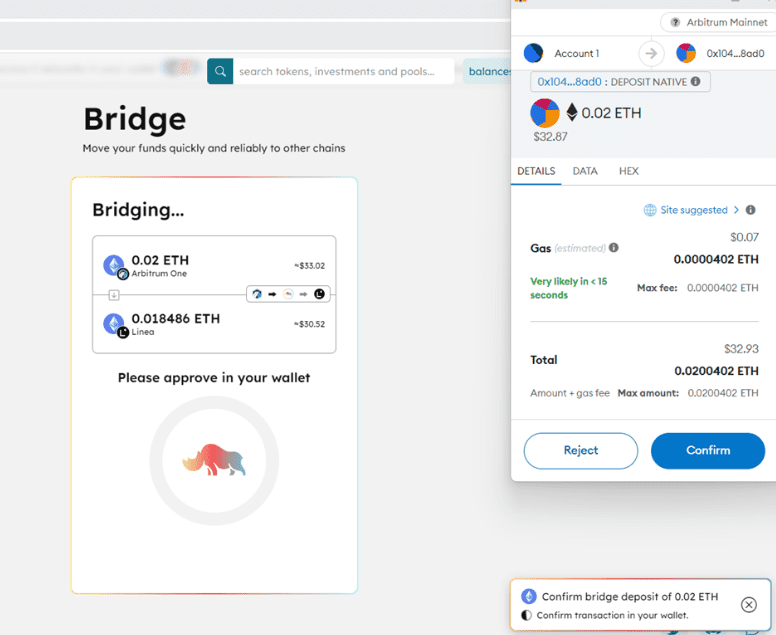

Step 2: Bridging

While you’re able to bridge, from the bridge display, choose the token you want to bridge, in addition to your output and vacation spot chain.

Enter the quantity you need to bridge, and it will mechanically generate the quantity that will likely be obtained on the vacation spot chain much less charges.

You’ll then be requested to ‘evaluation bridge’.

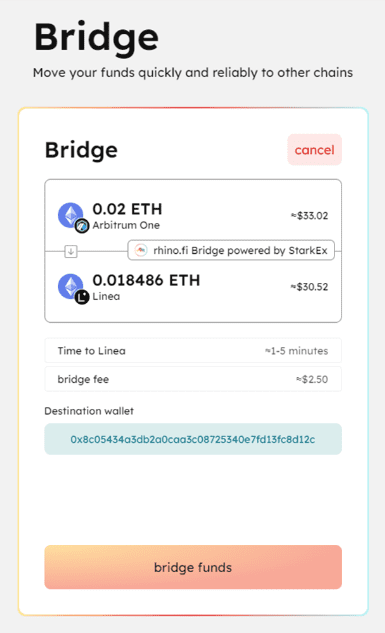

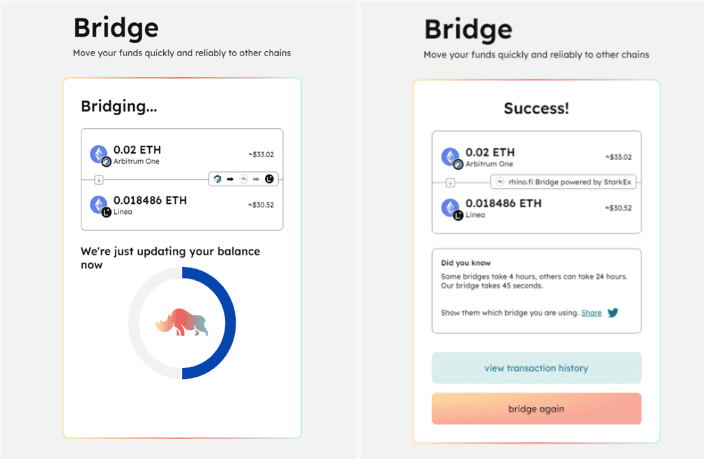

After you have reviewed the transaction, click on on ‘bridge funds’ which can immediate you to approve the transaction in your pockets.

After you have confirmed the transaction in your pockets, the bridge will begin, and at last it is going to notify you that your bridge has been profitable. You’ll be able to then all the time search for the bridge transaction within the ‘historical past’ tab of the app.

Is the Rhino.fi Bridge Secure?

Our bridge is authorised, which signifies that solely rhino.fi can challenge withdrawals to our bridges. Additionally, we use our personal funds as collateral. Within the transient historical past of DeFi, cross-chain bridges have suffered a small variety of safety exploits. However even when this had been to occur on rhino.fi (and, as we’ll point out beneath, we’ve put sturdy measures in place in opposition to this), the liquidity would come from rhino.fi, not our customers.

Self-custody is essential to rhino.fi. Not like centralised crypto exchanges, we let you hold full management of your funds, and our system of good contracts and consumer signatures is prime to this.

Nonetheless, there’s a small trusted factor within the bridging course of. As talked about, our customers give rhino.fi property on their origin chain and rhino.fi gives their desired property on their vacation spot chain. In different phrases, the consumer offers us tokens and trusts that we’ll give them tokens on one other chain.

This trusted factor is important to make sure velocity: if the method had been completely trustless, it may take as a lot as 20 minutes to maneuver from one aspect of the bridge to the opposite.

To additional decrease dangers, we’ve carried out rigorous checks and decrease pointless adjustments. Our contract adjustments bear thorough inside and exterior audits by industry-leading blockchain safety consultants, equivalent to PeckShield, and you’ll view them right here.

Abstract

In abstract, cross-chain bridging with rhino.fi opens doorways to various blockchain alternatives. We’ve coated the fundamentals, defined how our bridge operates, touched on charges, and mentioned safety. Now, you’re outfitted to navigate the world of DeFi with rhino.fi’s cutting-edge bridging options.