The newest Glassnode information on September 18 reveals that the proportion of Bitcoin provide held by long-term holders is near an all-time excessive of roughly 76%. The enlargement comes when the broader crypto market is recovering after crashing in latest weeks.

The truth that the quantity of cash owned by long-term holders is rising might point out a constructive shift in sentiment. Lengthy-term holders differ from speculators, who predict and gamble on value fluctuations for monetary achieve. Lengthy-term holders are people or organizations which have saved their cash for at the least 155 days.

In line with Glassnode, a blockchain analytics platform, the possibilities of these entities not spending after holding them for at the least 5 months, is decrease. Lengthy-term holders, generally often called “diamond fingers,” can help crypto costs by eradicating cash from circulation.

Extra Entities HODLing

Bitcoin is inherently deflationary, and solely 21 million cash will ever flow into. Nevertheless, with mining, cash will probably be repeatedly added to circulation till all 21 million are mined by 2140. Presently, there are 19.49 million cash in circulation, of which a big chunk is taken into account misplaced or irrecoverable.

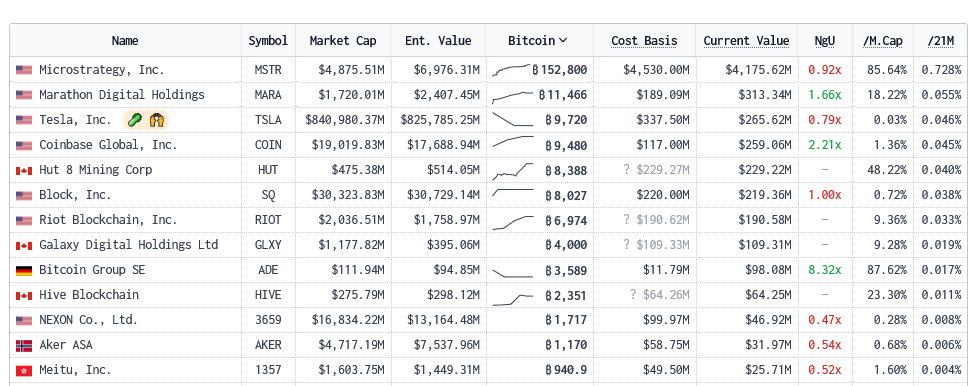

Satoshi Nakamoto, the USA authorities, and public firms like MicroStrategy maintain one other portion. In line with public information, MicroStrategy, a enterprise intelligence agency, is a publicly traded firm HODLing the biggest quantity of Bitcoin. As of September 19, the agency had purchased 152,800 BTC, roughly 15% of the overall quantity believed to be managed by the Bitcoin founder, Satoshi Nakamoto.

Bitcoin Provides 10%, Bulls Optimistic

When writing, Bitcoin is up roughly 10% from September lows, recovering steadily from across the $25,200 help. Regardless of the uptrend and bulls gaining momentum, the trail of least resistance, trying on the candlestick association from a top-down preview, is bearish.

Primarily based on technical evaluation, Bitcoin costs are nonetheless influenced by the August 17 bear bar, the conspicuous bear candlestick with excessive buying and selling volumes and wide-ranging that compelled costs under $28,000.

General, Bitcoin costs are boxed inside the June to July 2023 commerce vary, and consumers stand an opportunity as they bounce from key Fibonacci retracement ranges. Presently, the medium-term purchase goal is $31,800 or July 2023 excessive.

Nonetheless, it’s but to be seen how costs will react within the days or even weeks forward. When costs development greater, BTC HODLers will possible improve as extra intention to journey the uptrend earlier than taking income. In the meantime, investor sentiment might fall if costs pull again from spot charges, crumbling under $25,000 main help.

Function picture from Canva, chart from TradingView