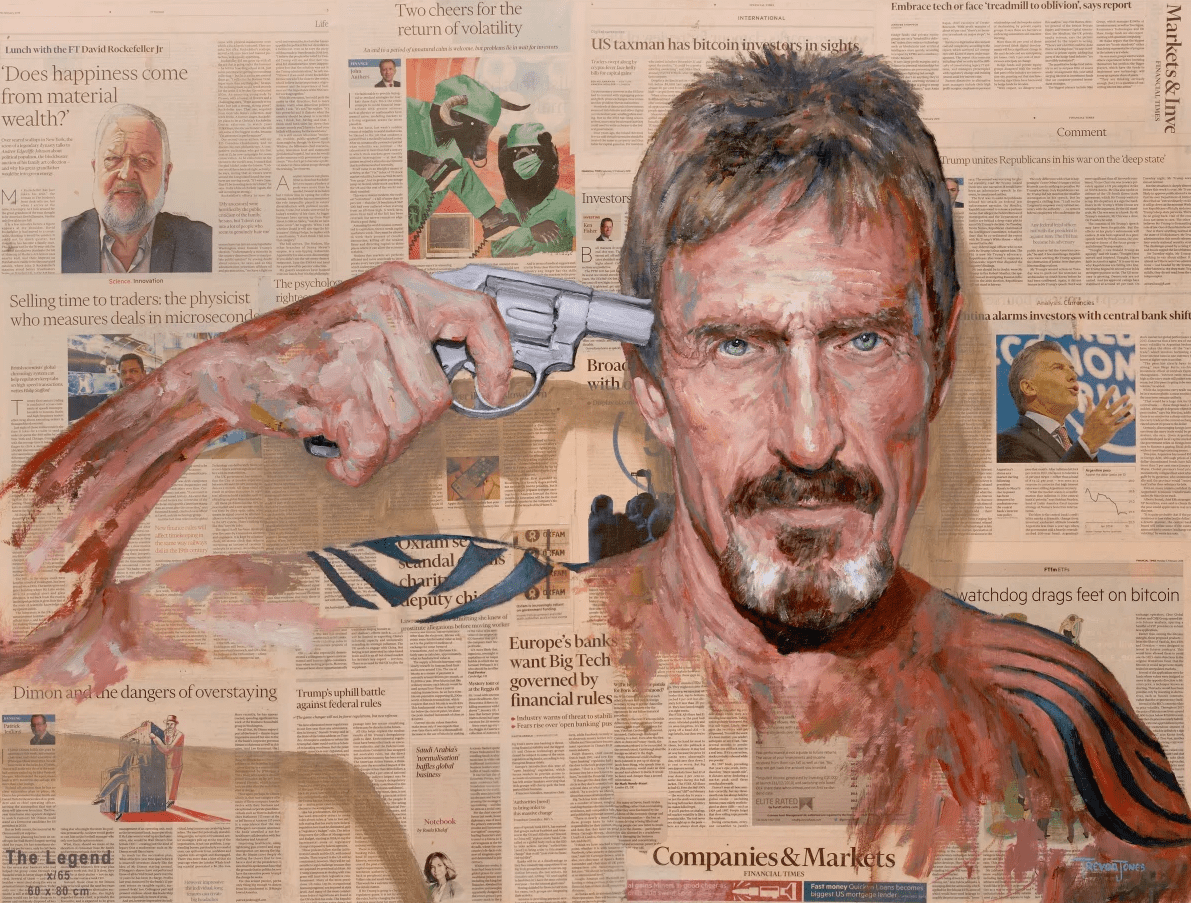

In keeping with a report by Reuters, German banking big Deutsche Financial institution has partnered with Swiss cryptocurrency agency Taurus to supply Bitcoin and crypto custody and different associated companies to its institutional purchasers.

“Because the digital asset house is anticipated to embody trillions of {dollars} of belongings, it is sure to be seen as one of many priorities for buyers and companies alike,” mentioned Deutsche Financial institution’s international head of securities companies, Paul Maley. “Our focus is not only on cryptocurrencies, however supporting our purchasers within the total digital belongings ecosystem.”

The announcement additionally comes at a time when regulatory readability across the trade is bettering. Governments and monetary regulators worldwide have been working to ascertain clear tips for the use and buying and selling of digital belongings.

In keeping with the report, Deutsche Financial institution is continuing “cautiously and consistent with the spirit and the letter of the rules governing this asset class.” Maley went on to additional clarify that “Our product design, and the character of custody for purchasers, will make it possible for there isn’t the chance of contaminating the financial institution’s different actions.”

Bitcoin continues to achieve momentum and recognition as a authentic asset class, with the asset turning into a really enticing funding possibility for hedge funds, household places of work, and different institutional buyers. Deutsche Financial institution’s determination to enter this market is seen as a strategic transfer to seize a share of this burgeoning market.