The primary spot Ether ETF software is submitted within the U.S. Google permits NFT promoting, and a mother will get group service for Crypto.com’s mistake?! These tales and extra, this week in crypto.

Spot Ether ETF Submitted within the U.S.

Cathie Wooden’s Ark Make investments, in partnership with 21Shares, seeks to launch the primary spot Ethereum ETF in the USA. The applying submitted to the SEC named Coinbase as custodian, which means the crypto change would maintain the Ether backing the ETF shares. If accredited, the fund would commerce on the Cboe BZX Change.

Google Permits NFT Recreation Adverts

Google has up to date its cryptocurrency promoting coverage to permit for blockchain-based NFT gaming commercials. So long as the advertisements don’t promote playing, Google now permits the promotion of NFT video games that enable gamers to buy in-game gadgets, like digital attire for a participant’s characters, weaponry, or armor utilized in a recreation to boost a person’s expertise.

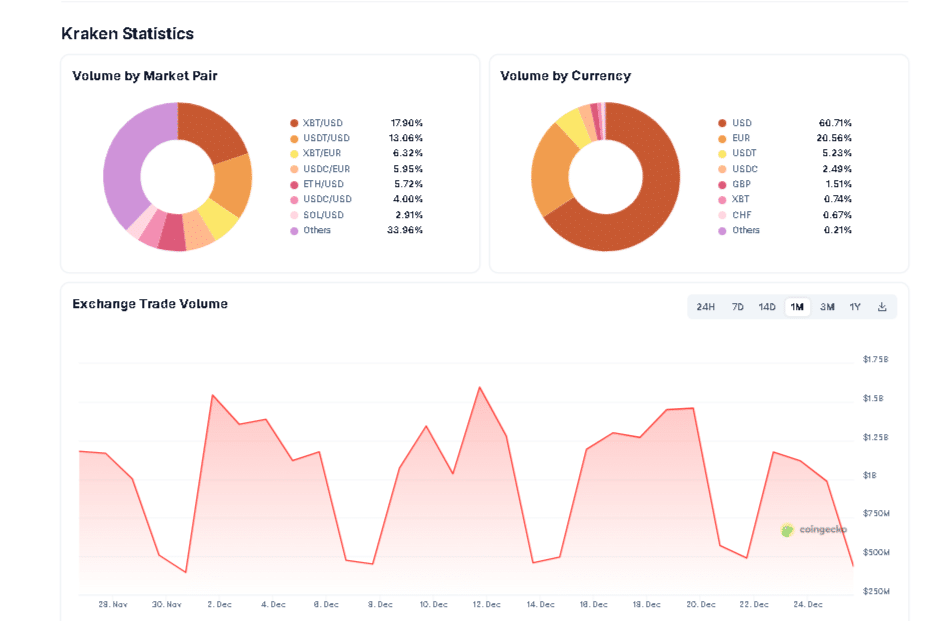

Kraken Expands Choices

Main US change Kraken is increasing its companies in the UK by Crypto Amenities Ltd., an organization Kraken acquired in 2019. Crypto Amenities provides crypto derivatives for institutional buyers, and is now in search of permission to supply asset custody companies for a broader vary of shoppers. Kraken additionally this week rolled out assist for PayPal deposits on its cellular app within the UK and Europe.

Thodex Founder Sentenced to 11,196 Years

Faruk Fatih Özer, founding father of Turkey’s defunct Thodex crypto change, has acquired a staggering 11,196-year jail sentence, together with a $5 million judicial nice. Thodex, as soon as a significant change in Turkey, abruptly shut down in April 2021, leaving 400,000 clients with inaccessible deposits totaling $2 billion. Özer fled to Albania however was captured by Interpol final August.

Texas Paid Bitcoin Miner Tens of millions

Bitcoin miners in Texas are quickly halting operations to alleviate the state’s energy disaster. One of many bigger mining corporations, Riot Platforms, acquired $31 million in power credit from the Electrical Reliability Council of Texas (ERCOT) in August for agreeing to cut back its power consumption. This extra income stream considerably offsets their mining prices, positioning Riot as one of many trade’s most cost-efficient bitcoin producers.

Truthful Worth Accounting Is Coming to Bitcoin

The Monetary Accounting Requirements Board has accredited new accounting guidelines for firms holding or investing in digital property. The brand new guidelines, set to take impact in 2025, would require corporations to report digital asset holdings on the extra up-to-date truthful worth, relatively than at historic worth, as is the present customary. One of many largest company holders of Bitcoin is Michael Saylor’s Microstrategy, which sees this transformation as a optimistic, as again in Might, its CFO Andrew Wang wrote to the FASB in assist of the unique proposal.

G20 Prompt to Comprise Crypto Dangers

G20 international locations got an inventory of proposed actions to accommodate digital currencies. The important thing measures proposed by the IMF and the Monetary Stability Board embrace that crypto property not be granted official forex standing, nor ought to they be included in central financial institution holdings attributable to potential dangers of destabilization. The proposal additional emphasizes clear tax therapy, worldwide cooperation, and transparency from world stablecoin issuers to guard customers and guarantee well timed redemption.

Australian Mum Sentenced for Cashing $10M

An Australian mom acquired a 209-day jail sentence and 200 hours of group work for trying to maintain a mistaken $10 million deposit from Crypto.com. She and her boyfriend, who reportedly informed her a narrative that he’d gained a crypto.com contest, have been accused of spending the funds on property and luxurious gadgets. She gained’t spend any extra time in jail, although, because the sentence quantities to time served earlier than her launch on bail final yr.

That’s what’s occurred this week in crypto, see you subsequent week.

.gif?format=1500w)