In November 2024, the present Zcash growth fund will expire. Conversations a couple of new dev fund have begun, and neighborhood sentiment appears to favor adjustments relating to who receives Zcash issuance and the way a lot issuance they obtain. There’s little assist for carrying over the present construction into a brand new dev fund, and there’s a vocal minority who advocates in opposition to any new dev fund.

A bit of over a month in the past, I gave a presentation at Zcon4, the annual convention hosted by the unbiased Zcash Basis, in regards to the significance of the Zcash dev fund and why it’s Zcash’s superpower. I made the argument that each resolution is about balancing trade-offs and that the neighborhood wants to contemplate this in structuring funding and governance.

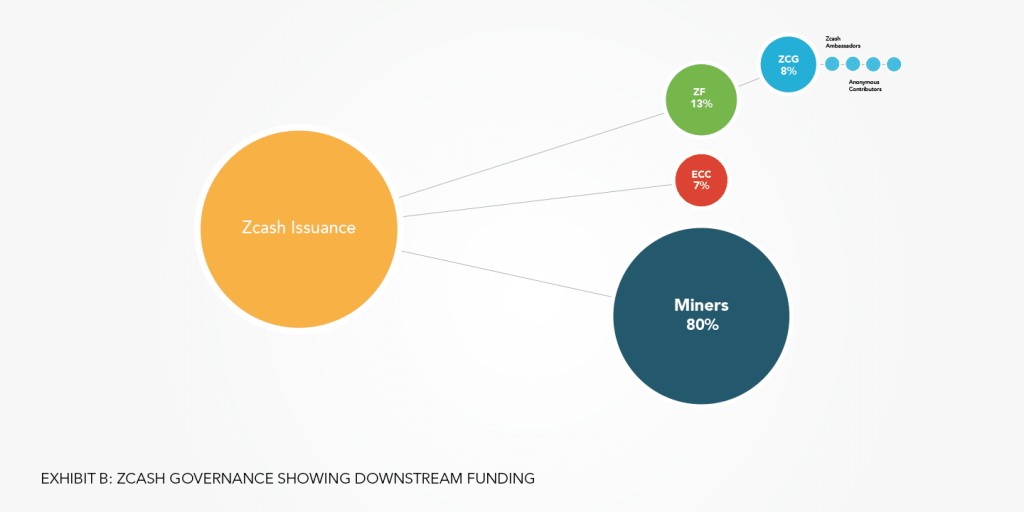

For context, right here’s a standard view of how Zcash neighborhood funding works as we speak: 80 % of Zcash issuance is distributed to miners, whereas 20 % is dedicated to Zcash growth funding. Importantly, 8 % of the whole block reward (or about 40 % of the present dev fund) goes into the Zcash Group Grants group, which completely funds unbiased third-party builders. ECC (by way of the Bootstrap org) receives 7 % of the whole rewards, and the remaining 5 % goes to the Zcash Basis.

Whereas this view of funding and governance is correct, there are alternate views which are additionally correct.

Tradeoffs within the present dev fund construction

“There aren’t any options. There are solely trade-offs.”

Thomas Sowell

The Zcash Group Grants group truly receives its funding by way of the Zcash Basis; it doesn’t obtain funds instantly. It was arrange this manner for good causes (primarily, creating an entirely new and separate entity is pricey), and Exhibit B represents this movement of cash.

In ZIP 1014, the neighborhood stipulated that the Zcash Basis should not intervene with Zcash Group Grants’s choices, and each the Zcash Basis and Zcash Group Grants ought to be recommended on their monetary transparency. In a majority of circumstances, this construction by which cash flows by way of the Zcash Basis to the ZCG to unbiased builders and groups is simply high-quality.

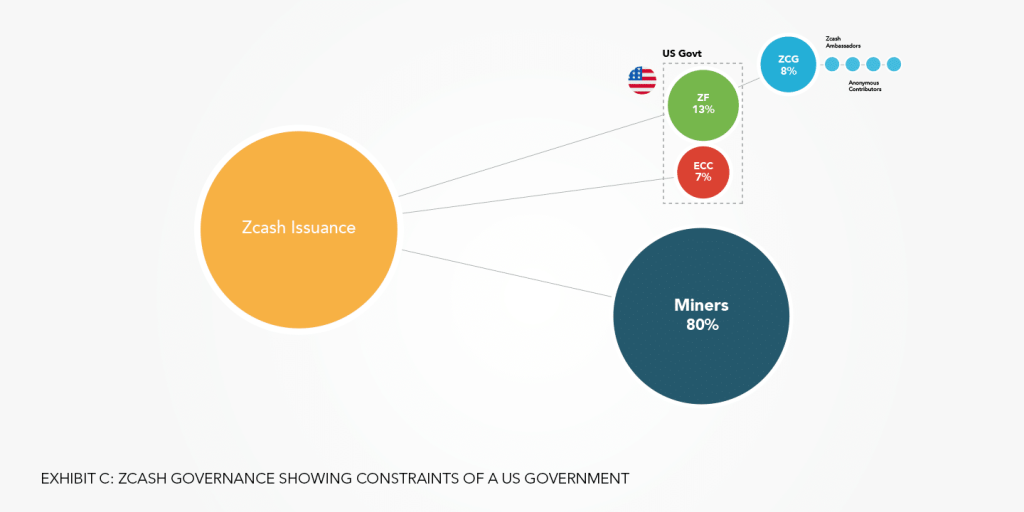

However the tradeoff is that the Zcash Basis is beholden to US legal guidelines* which signifies that any group or staff that’s downstream of the Zcash Basis can also be constrained.

In my Zcon4 presentation, I highlighted two current examples of the real-life implications of this construction.

In 2022, an individual residing in Iran who goes by Bitcoin Buddy utilized for a grant to develop into a Zcash ambassador. They wrote about residing underneath a theocratic dictatorship and incompetent kleptocracy that inflicts poverty and permits girls to be attacked within the streets. Their objective was to inform their neighborhood about Zcash and body it as a substitute or an “escape” from the oppressive Iran ruling regime. I think Zcash Group Grants would have preferred to fund Bitcoin Buddy, however it couldn’t as a result of its cash flows by way of the Zcash Basis, which relies within the US, is topic to the legal guidelines of the US, and would discover its nonprofit standing at jeopardy by funding an individual or venture in Iran.

In one other instance, a staff of engineers who wished to stay nameless utilized for funding to construct and implement new code on Zcash. Nevertheless, as a result of the staff refused to provide data like names and residential addresses, a US KYC (Know Your Buyer) requirement, its utility was rejected.

If these eventualities alone don’t exhibit the necessity for adjustments in a “Dev Fund 2,” contemplate that ECC, the group I lead, can also be based mostly within the US and topic to the legal guidelines of the US, which signifies that all dev fund monies are constrained by the legal guidelines of a single authorities and regulatory framework.

It’s value noting that miners, who obtain 80% of all Zcash issuance, dwell exterior the management of the US authorities and usually are not certain by guidelines on how they use that issuance.

A metric for Zcash sustainability and resilience

One helpful technique to tackle trade-offs is to take a look at a metric: the variety of unbiased and sustainable organizations that assist Zcash.

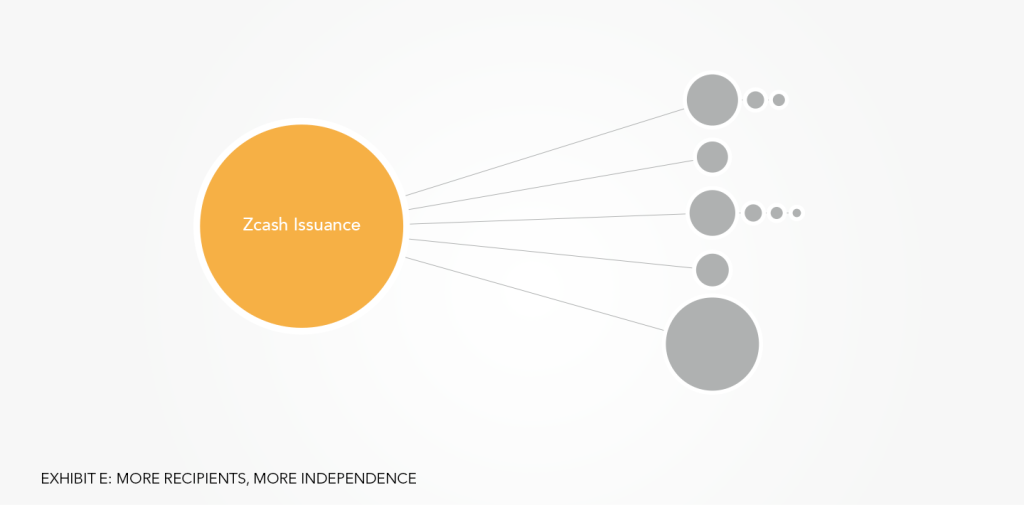

Exhibit A exhibits us that the quantity is three: ECC, Zcash Basis, and Zcash Group Grants. Exhibit B illustrates that there are solely two, and Exhibit C suggests that every one of those organizations are consolidated and beholden to 1 entity, the US authorities. (I don’t depend miners as supporters of Zcash as a result of, to my data, not one of the giant industrial miners do something to enhance Zcash. And in reality, most promote it on the finish of every day to purchase Bitcoin.)

There’s an ineluctable trade-off between independence and accountability. For any circle in these illustrations, you possibly can select independence or accountability, however just one attribute, not each.

In Exhibit B, for instance, the Zcash Basis serves a priceless function, which is that it holds Zcash Group Grants accountable to its cost. However as a result of it’s downstream of the Zcash Basis, Zcash Group Grants isn’t truly unbiased.

On the blockchain degree you possibly can create accountability by the neighborhood as an entire including and eradicating recipients of a dev fund, however under the blockchain degree independence and accountability are a trade-off.

Failure modes

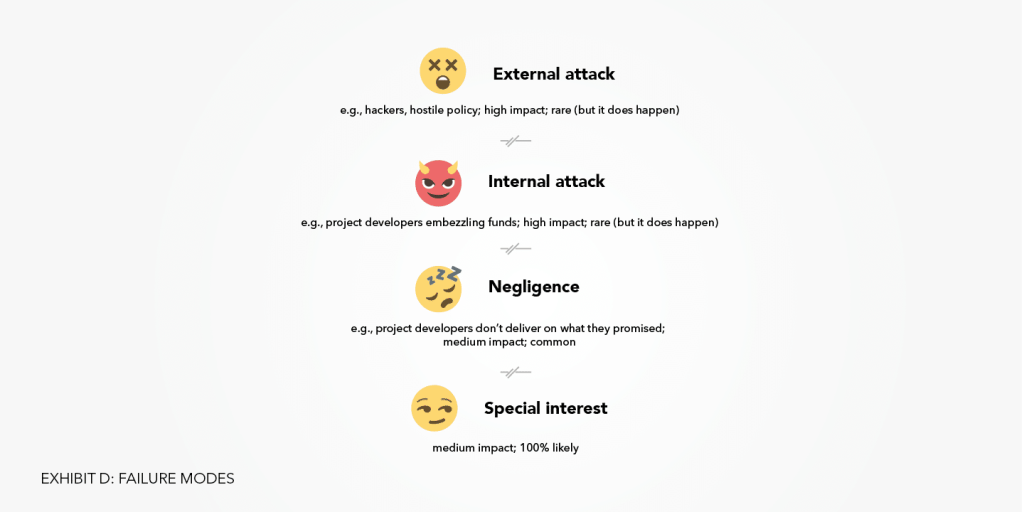

As a safety engineer, I actually like fascinated about failure modes. In Exhibit D, I break them into 4 classes.

The primary two failure modes, exterior and inner assaults, are fairly self-explanatory. Both may have a huge effect and even trigger catastrophic failure of a venture. US coverage seems to be lining up in opposition to crypto as an trade, however for now, I nonetheless categorize these failure modes as “uncommon.”

Class 3, nevertheless, is widespread. Sadly, two-thirds of everybody who units out to do something by no means fairly finishes, as a result of success requires a mixture of imaginative and prescient, timing, expertise, and luck. When designing governance, we should pay attention to and defend in opposition to a easy legislation of the universe: Regardless of how well-intentioned and expert an individual or staff seems to be, there’s a not-insignificant probability they may fail to dwell as much as expectations.

The final failure mode, Class 4, is 100% possible. Each individual and each group of individuals is a particular curiosity with differing motivations, differing blindspots, and differing values and views. Programs of governance have to be resilient sufficient to provide good outcomes regardless of this common legislation.

Designing the subsequent Zcash dev fund

Even with assured failure modes and sophisticated tradeoffs, it’s doable to design a governance system that will increase the sustainability and resilience of Zcash.

As I stated at Zcon4, “Don’t put all of your eggs in a single basket.” The subsequent dev fund the Zcash neighborhood implements must (1) embody extra, unbiased groups than the present iteration, and (2) at the very least a type of groups ought to be headquartered exterior the US.

No governance mannequin is ideal, however my opinion is that these two suggestions will foster lasting advantages for Zcashers and the way forward for Zcash. I’ve extraordinarily excessive confidence within the voice of the neighborhood, and I’m trying ahead to persevering with this dialog into 2024 and past!

*The Zcash Basis lately introduced that it has begun the method of establishing an operational nonprofit entity within the Cayman Islands, in order that’s good news!