In a brand new analysis report, Constancy examines the burning query: how does the utility of the Ethereum community translate into worth for its native cryptocurrency, ETH?

Whereas customers have loved the technological advantages of Ethereum’s intensive ecosystem, the funding neighborhood has sought to know the explanations behind buying and holding ETH past its utility as a transactional token.

Constancy’s Ethereum Funding Thesis delves into the worth proposition of ETH from an funding thesis perspective, whereas additionally dissecting the technical features associated to varied funding theses.

Key observations from the report embrace:

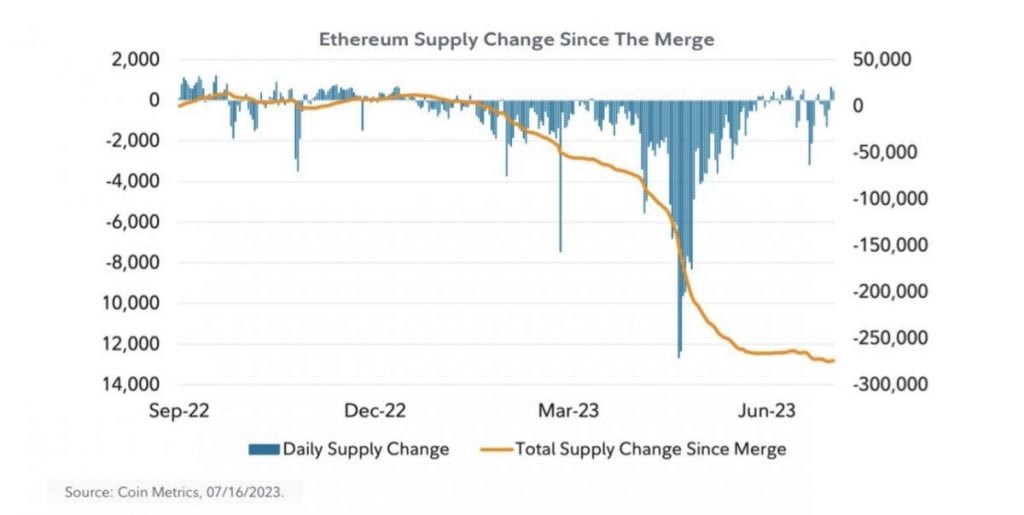

Worth Linked to Community Utilization: The perceived worth of Ethereum is tied to community utilization and the dynamics of provide and demand, which have advanced considerably for the reason that implementation of The Merge.Platform Utilization and Worth Accrual: Elevated utilization of the Ethereum community and platform could contribute to the buildup of worth for Ether token holders.Ether as an Rising Type of Cash: One funding thesis posits Ether as an rising type of digital cash, akin to Bitcoin.Challenges in Competing with Bitcoin: The report acknowledges that whereas different digital property, together with Ether, could try to function types of cash, competing with Bitcoin’s traits and community results could possibly be a formidable problem.Ether’s Features as Cash: The report explores Ether’s potential to satisfy two main capabilities of cash: a retailer of worth and a way of fee.

Ether’s Aspiration as Cash

A prevailing narrative within the cryptocurrency house usually positions Bitcoin as a nascent type of digital cash. This begs the query: Can ETH assume the same function? In essence, can or not it’s thought of “cash”?

The reply, as per Constancy’s evaluation, is affirmative however comes with caveats. ETH does certainly share a number of traits with conventional types of cash, together with Bitcoin, reminiscent of its function as a medium of change. Nonetheless, there are notable variations to contemplate.

Challenges in Changing into Extensively Accepted

One of many key challenges ETH faces in changing into a extensively accepted type of cash is its provide dynamics. In contrast to Bitcoin, which adheres to a set provide schedule and is seen as a safe and sound digital foreign money by many, ETH provide parameters are technically limitless. These parameters can fluctuate based mostly on components just like the variety of validators and burning mechanisms.

Moreover, ETH’s monitor file as a financial asset differs from Bitcoin’s. Ethereum undergoes community upgrades roughly every year, requiring time and developer consideration to ascertain a secure efficiency historical past. That is necessary for garnering belief amongst stakeholders.

Competing Types of Cash

Whereas Bitcoin holds a robust place as a financial asset, Constancy means that this doesn’t preclude the existence of different types of digital cash, together with ETH.

Ethereum’s distinctive attributes, reminiscent of its potential to facilitate advanced transactions and execute good contract logic, set it aside from its digital foreign money counterparts. These capabilities present it with a novel utility past being a easy medium of change.

Actual-World Ethereum Integrations

Whereas widespread on a regular basis transactions on Ethereum are but to materialize, Constancy offers examples of already noteworthy integrations between the Ethereum ecosystem and the bodily world in addition to the standard finance sector:

MakerDAO’s Multimillion-Greenback Buy: MakerDAO, a venture working on the Ethereum blockchain, just lately accomplished a considerable buy of $500 million, highlighting Ethereum’s rising affect.Ethereum’s Function in Actual Property: Ethereum marked a historic milestone because the platform for the sale of the primary U.S. home utilizing a non-fungible token (NFT), showcasing its potential to disrupt the true property market.Blockchain Bonds by European Funding Financial institution: The European Funding Financial institution ventured into the blockchain realm by issuing bonds straight on the blockchain, an indication of conventional finance’s rising embrace of Ethereum’s know-how.Franklin Templeton’s Ethereum-Powered Cash Market Fund: Franklin Templeton launched a cash market fund using Ethereum and Polygon to streamline transaction processing and file share possession.

Challenges on the Path to Mass Adoption

Whereas the convergence of the Ethereum ecosystem with real-world property is undeniably underway, the report means that there are robust challenges to beat.

These embrace the necessity for steady community enchancment, regulatory readability, training, and the passage of time to instil confidence in Ethereum and comparable platforms.

It might take years earlier than Ethereum sees widespread adoption for on a regular basis transactions, making ETH a distinct segment type of cash in the interim.

Constancy’s Concluding Thought

In accordance with Constancy, the important thing query on the minds of traders is whether or not Ethereum’s sturdy developer exercise and the proliferation of purposes translate into tangible worth for ETH.

“We now have proven that, in each idea and information to date, elevated exercise on Ethereum’s community drives demand for block house, which, in flip, generates money movement that may accrue to token holders,” Constancy concludes.

“What can be evident, although, is that these varied drivers are advanced, nuanced, and have modified over time with varied protocol upgrades and the emergence of scaling developments, like layer 2, and should change once more sooner or later.”