Information reveals the crypto futures market has seen a considerable amount of liquidations on Wednesday as Bitcoin has registered a pointy surge.

Crypto Liquidations Whole At $170 Million Throughout Previous 24 Hours

On Tuesday, August 29, information broke out that Grayscale has emerged victorious towards the US Securities and Trade Fee (SEC) in its lawsuit. Bitcoin fans have lengthy speculated that this victory might pave the way in which for a spot Bitcoin Trade Traded Fund (ETF), so, it’s not shocking that the market has positively reacted to it.

Till Tuesday, BTC had been caught in consolidation for fairly some time, however with the information, the cryptocurrency lastly escaped out of this sideways motion in spectacular vogue as its value shot up towards the $28,000 degree.

The asset couldn’t preserve at these excessive costs for lengthy, nevertheless, because it quickly retraced again towards the present $27,400 mark. The under chart reveals the unstable value motion that BTC has noticed lately.

Appears like the worth of the asset has noticed a pointy surge in the course of the previous day | Supply: BTCUSD on TradingView

Even with this pullback, although, Bitcoin has been in a position to maintain onto the vast majority of its returns. With income of just about 6%, BTC is one of the best performer among the many high 10 cash within the crypto sector within the final day.

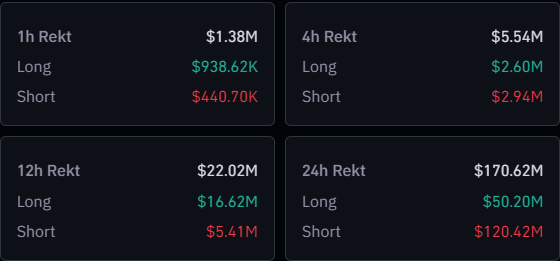

As the value motion prior to now 24 hours has been fairly sharp, the futures market has naturally gone by means of some chaos. Right here’s a desk that reveals the info associated to liquidations within the sector throughout this era:

A considerable amount of liquidations look to have occurred in the course of the previous day | Supply: CoinGlass

It could seem that the crypto futures market has noticed liquidations amounting to $170 million prior to now 24 hours, which is undoubtedly a fairly vital quantity.

Solely round $22 million of those liquidations occurred throughout the final 12 hours, nevertheless, as many of the volatility was restricted to the earlier 12-hour interval.

From the desk, it’s additionally seen that $120 million of the liquidations got here from the quick contracts alone, representing 70% of the entire. The liquidation occasion was triggered by a pointy rally throughout the market, so it could make sense that the shorts could be those who’ve taken many of the brunt.

The quantity of lengthy liquidations ($50 million) nonetheless isn’t insignificant, although, because the pullback BTC noticed from $28,100 to $27,400 additionally punished the speculators who got here late to the social gathering.

The occasion on Wednesday is an instance of a “liquidation squeeze.” In squeezes, a mass quantity of liquidations occurs following a pointy swing within the value, and these liquidations solely find yourself feeding the value transfer additional.

This amplified value transfer then finally ends up inflicting much more liquidations in a kind of chain response. In order the vast majority of the liquidations prior to now day had been shorts, the occasion was a “quick squeeze.”

Giant futures flushes just like the one prior to now day aren’t one thing that unusual within the crypto sector, owing to the truth that the cash are typically fairly unstable and absurd quantities of leverage might be simply accessible throughout many of the platforms.

Featured picture from Kanchanara on Unsplash.com, chart from TradingView.com