Metaversal is a Bankless publication for weekly level-ups on NFTs, digital worlds, and extra!

Pricey Bankless Nation,

As soon as an easy course of, the enforcement of NFT royalties has turn out to be a contentious situation as extra platforms have shifted to creating royalties elective.

As we navigate this new period of uncertainty, it is key to know the shifts in royalty practices and discover inventive options that empower artists whereas preserving the decentralized ethos on the coronary heart of NFTs.

On this publish, we’ll go over a timeline of how we received right here and workarounds that may hold the magic of NFTs alive for creatives!

Let’s get to it.

-WMP

🙏 Sponsor: Uniswap Labs — Higher Costs, Extra Listings: NFTs on Uniswap✨

There was a time a couple of years in the past when OpenSea was the one NFT market round. If an NFT offered throughout that point, it undoubtedly offered on OpenSea.

On this atmosphere, when you have been a creator and set a 10% royalty fee on OpenSea, then you definitely made a ten% lower any time one among your items resold in a secondary sale. Fairly cool, proper?

Fairly cool certainly, and that was a actuality that attracted many artists to NFTs through the 2021 bull run. However royalty funds right here began cratering final 12 months, so right here’s a fast timeline of occasions which have introduced us to the place we’re at the moment:

July 2022 — sudoswap, beforehand an over-the-counter (OTC) NFT buying and selling app, launched its automated market maker (AMM) protocol, initially with out enforcement of NFT royalties on secondary gross sales.

October 2022 — Blur, an “NFT market for professional merchants,” launched, and likewise initially with none NFT royalties enforced; the platform shortly accrued main buying and selling quantity upon saying plans for a number of rounds of $BLUR airdrops.

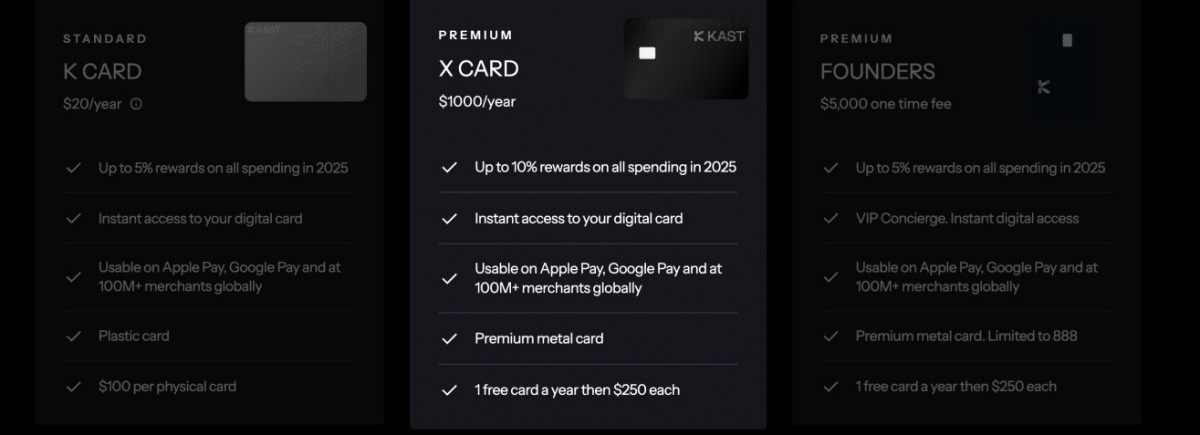

November 2022 — OpenSea launched the Operator Filter, code that collections might undertake with the intention to block buying and selling of their NFTs on marketplaces that didn’t honor royalties on the time, e.g. Blur, LooksRare, NFTX, sudoswap, and so on.; opting in to this filter grew to become required if collections wished their royalties enforced on OpenSea.

January 2023 — Blur tapped into OpenSea’s Seaport market protocol to bypass the Operator Filter, making it in order that NFTs might be traded and a minimal royalty fee of 0.5% enforced throughout each Blur and OpenSea; paradoxically, creators needed to block Blur by way of the Operator Filter to make use of its parallel Seaport workaround.

February 2023 — OpenSea quickly dropped its market price to 0% and launched elective royalty funds, with enforcement of a minimal 0.5% fee if patrons didn’t volunteer to do extra.

June 2023 — sudoswap launched its v2 protocol with native help for onchain royalties by way of ERC2981 and Manifold’s Royalty Registry; thus the challenge some credited with kickstarting the race to 0% royalties has now come full circle and are available out swinging with programmatic help for them.

August 2023 — OpenSea introduced plans to sundown its Operator Filter as a result of a scarcity of “buy-in of everybody within the web3 ecosystem,” including that it could push forward with elective NFT royalties and would work to focus on a “creator’s most popular price” for each patrons and sellers.

🔒 You are a free person and do not have entry to Airdrop Hunter

If you happen to wanted a purpose to improve to a paid membership, that is it. A single airdrop pays for an annual membership’s value many instances over!

Finally, OpenSea and Blur have made NFT royalties elective on their platforms to take care of worth competitiveness.

As issues stand amid this battle for one of the best costs, it appears unlikely these juggernauts can be doubling again to help full, creator-set royalties any time quickly.

To regulate to this new period of uncertainty round royalties, then, creatives working round NFTs can contemplate a variety of choices. Right here I’d level you to:

📦 Holding again provide — Manually or programmatically mint 1/1s or editions to your pockets throughout drops for potential secondary market gross sales later.

⏲️ Zora’s Auto-Reserve — An opt-in system creators can use to mechanically mint NFTs from their very own drops to their wallets at repeatedly scheduled intervals, e.g. each tenth mint.

🛠️ DIY marketplaces — Construct your individual royalty-friendly market to your assortment; on the easier facet listed here are no-code options like Rarible’s Neighborhood Marketplaces builder, whereas Reservoir gives extra superior potentialities for devs.

🎨 Use pro-royalty platforms — Focus your efforts round initiatives that proceed to totally honor NFT royalties, together with Artwork Blocks, Basis, KnownOrigin, Manifold, Nifty Gateway, Rarible, sudoswap v2, SuperRare, and Zora.

Manifold’s Royalty Registry — The Royalty Registry x Royalty Engine combo is an opt-in onchain royalty system; it lets initiatives configure their royalty settings and taking part marketplaces to seek for these settings with the intention to honor them.

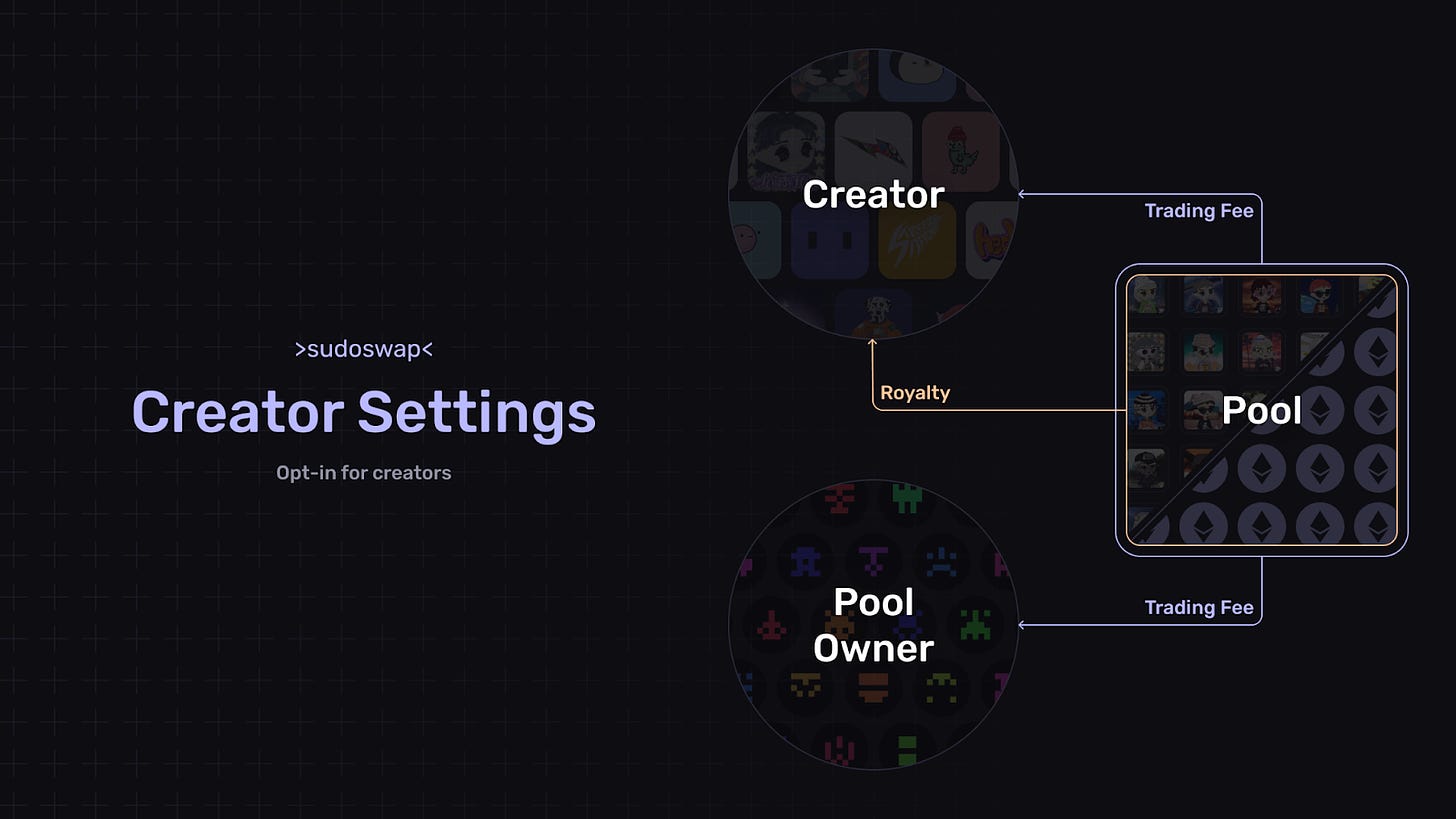

sudoswap’s Creator Settings — This new good contract system lets NFT creators supply decreased royalties in change for a share of buying and selling charges from sudoswap liquidity swimming pools; it’s extremely versatile, with customizable liquidity-lockup intervals and past.

Earn by way of tading charges — For instance, it’s solely doable on sudoswap to arrange a liquidity pool of many ERC1155 NFT editions after which earn from buys and sells made by means of the pool over time.

Infinity mints — Visualize Worth just lately pioneered the Infinity assortment format, the place a drop’s mint funds are saved in a sensible contract and are 100% withdrawable if a collector ever needs to promote their piece later; a creator might use this format with, say, a 5% mint tax to allow them to earn whereas nonetheless providing 95% refunds to collectors at any time.

NFT royalties are by no means comprehensively enforceable. For instance, recall that the Royalty Registry system is opt-in. In sort, offchain methods are additionally clearly voluntary and main platforms like Blur and OpenSea have deemphasized them in a race to the underside fees-wise.

Moreover, as Foobar has beforehand famous in “On Royalties,” widespread recommendations to implement royalties, similar to hardcoding switch charges into tokens or blacklisting marketplaces, can break important NFT practices like free wallet-to-wallet transfers or be simply circumvented, e.g. by way of “wrapper” good contracts.

DCInvestor as soon as stated (and Foobar highlighted within the aforementioned publish) that “NFTs are greatest as permissionless, censorship-resistant bearer property,” i.e. they’re most compelling when house owners get pleasure from full possession that may’t be undone. Steam can rug your video games property, not your NFTs, Instagram can rug your artwork, not your cryptoart, X (previously Twitter) can rug your username, not your ENS, and so on.

The reply right here isn’t limitless centralized god mode, through which creators can burn holders’ NFTs and so forth. It’s in committing to or doubling down on the workarounds talked about within the earlier part of this write-up in order that creators can stay empowered whereas additionally supporting and tapping into the quintessential magic of NFTs!

William M. Peaster is the creator of Metaversal — a Bankless publication centered on the emergence of NFTs within the cryptoeconomy. He’s additionally a senior author for the principle Bankless publication.

A Bankless Citizen ⚑ turned $264 into $6,077 final 12 months. A 22x ROI 🚀 in a bear market!

Commerce NFTs throughout main marketplaces to search out extra listings at higher costs. NFTs on Uniswap are open-source, trustless, and self-custodial. To have a good time NFTs on Uniswap, we’re airdropping $5 million to sure historic Genie customers. Begin buying and selling NFTs at the moment on Uniswap.

👉 Get Began Now!

Not monetary or tax recommendation. This text is strictly academic and isn’t funding recommendation or a solicitation to purchase or promote any property or to make any monetary selections. This text isn’t tax recommendation. Speak to your accountant. Do your individual analysis.

Disclosure. From time-to-time I’ll add hyperlinks on this publication to merchandise I exploit. I’ll obtain fee when you make a purchase order by means of one among these hyperlinks. Moreover, the Bankless writers maintain crypto property. See our funding disclosures right here.